The Loan Programs Office (LPO) takes seriously its responsibility to protect taxpayer resources. Learn more about how LPO manages risk and proactively monitors its growing portfolio.

Office of Energy Dominance Financing

November 3, 2022The Loan Programs Office (LPO) takes seriously its responsibility to protect taxpayer resources. Ever since its first loan programs were authorized by Congress in the Energy Policy Act of 2005, LPO has been evolving and making improvements to the office that have increased both internal and interagency oversight, clarified its management responsibilities, institutionalized risk management practices, and put in place portfolio-wide safeguards and monitoring of all LPO projects, among other enhancements.

Establishing a proactive risk management culture at LPO has been necessary given its mission to provide a bridge to bankability for innovative technologies and other projects essential to our energy future that are unable to access commercial debt markets.

One of the clearest examples of this progress can be seen in how we have addressed recommendations dating back to the 2012 independent audit of LPO and its portfolio, performed at the behest of the White House by Herb Allison. The Allison Report, as it’s referred to colloquially, reflects on LPO’s earliest days and projects.

The progress we have made since that time is substantial:

- LPO has established a robust and consistent process for deep due diligence of applications in review.

- LPO has improved internal and external coordination of the processes involved in the oversight of LPO programs.

- LPO proactively monitors and manages transactions after loan closing through a dynamic portfolio management process.

- And LPO has created a leadership and organizational structure, including a Risk Management Division (RMD) and Portfolio Management Division (PMD), staffed with professionals with deep experience in underwriting and monitoring complex transactions and for whom responsible stewardship of taxpayer money is a top priority.

Deep Due Diligence and Utilization of that Diligence in Credit Decisions

The Department conducts rigorous due diligence that is comparable to, if not more stringent than, what might be done in the private sector. Due diligence includes eligibility determinations and technical, market, financial, credit, legal, and regulatory reviews, among other items. This involves thorough, comprehensive credit underwriting of the transaction with robust risk management processes infused throughout. Through this process LPO identifies clear conditions that must be met prior to closing and funding a given transaction.

Increased Coordination and Oversight

Transactions undergo internal LPO validation (by RMD), interagency review, DOE Credit Review Board (CRB) review and Secretary approval. LPO submits detailed information about the project to the Office of Management and Budget (OMB) and the U.S. Department of the Treasury (U.S. Treasury). OMB reviews the transaction to support the LPO Risk Management Division’s estimation of the credit subsidy cost for all loan programs. U.S. Treasury reviews transactions, which includes providing the required written analysis of the financial terms and conditions of the proposed loan for Title 17 transactions. The CRB, composed of senior DOE officials from outside of LPO, is routinely briefed on pending transactions, and the decision about whether to move forward with a given transaction is put to the CRB for a vote prior to conditional commitment. If a transaction receives CRB approval, it goes to the Secretary of Energy for approval, and a conditional commitment is issued to the applicant.

Proactive Portfolio Management

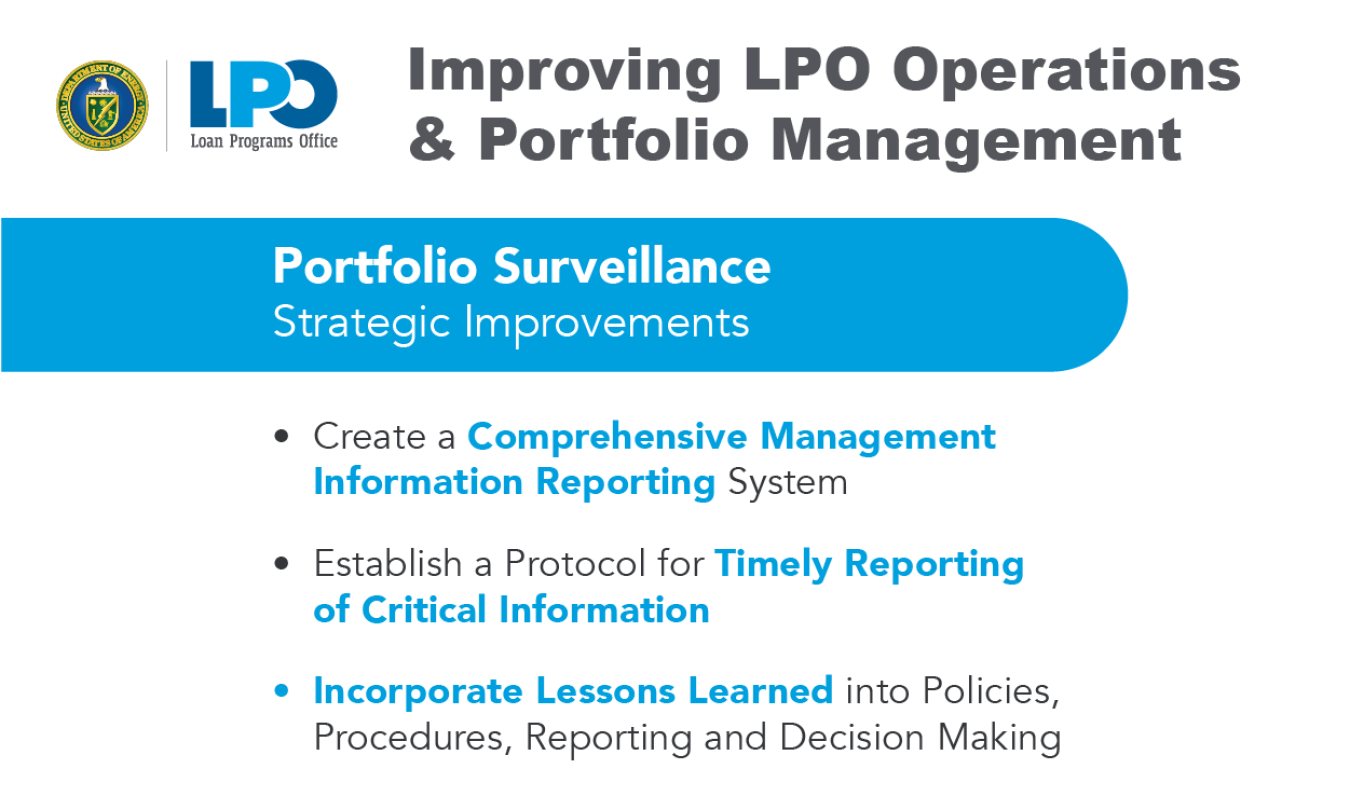

Once a loan closes, the Portfolio Management Division (PMD) leads LPO’s loan monitoring process through the end of a loan term. PMD serves as the principal liaison between the borrower and LPO post-close; manages approval of disbursements, consent, waivers, modifications, amendments, and other action requests (PMD coordinates review of post-issue requests with other members of the LPO deal team, external experts, and DOE’s Risk and Portfolio Monitoring Committee as needed depending on the nature of the request and loan status); monitors project cash flows to ensure debt repayment; and reports portfolio performance to senior leadership on an ongoing basis. PMD also conducts proactive surveillance on the loan portfolio; routinely assesses the credit risk of its borrowers; and continues to update LPO’s internal risk rating, which indicates the expected probability of default and loss. When borrowers present warning signs of distress, PMD acts by leading workout and remediation efforts to maximize recoveries. And, at least once per year, RMD reviews the work of PMD. Taken together, ongoing proactive portfolio management measures help projects succeed even when, because of LPO’s unique mission, those projects may possess lower credit ratings or higher technology risk.

Reporting to the Public

LPO reports on the performance of the portfolio and any recent notable project developments or progress updates for the previous Fiscal Year in the Annual Portfolio Status Report.

LPO constantly updates its website with relevant program changes, including loan program guidance, information about solicitations, the Monthly Application Activity Report, active portfolio of projects summary page, and new deals—as well as other timely news and updates on this blog.

LPO also reports on metrics, such as the types of technologies supported by its projects, jobs created associated with projects, an estimate of avoided pollution or emissions, and other factors consistent with report requirements from the Energy Act of 2020 and the Infrastructure Investment and Jobs Act.

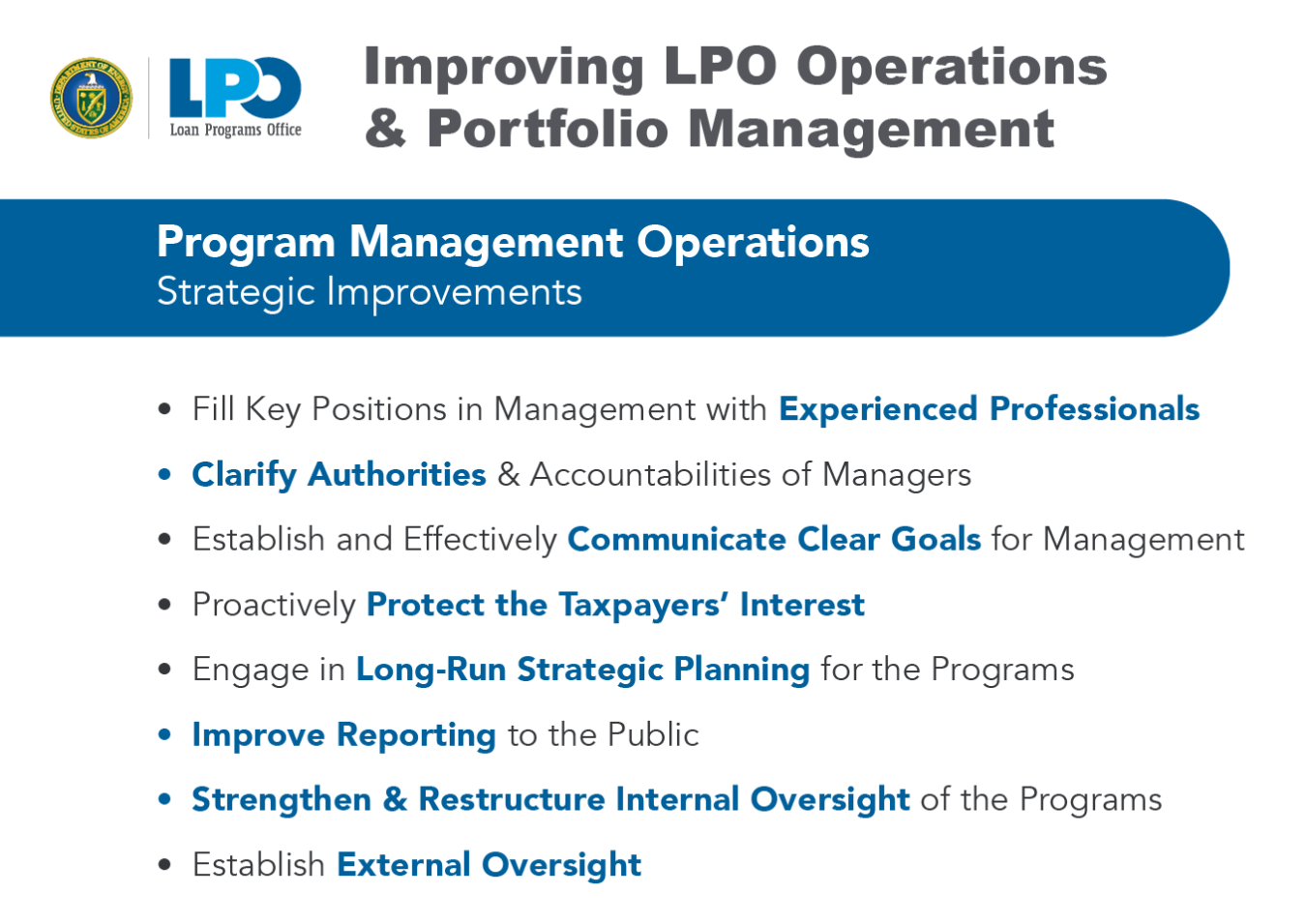

Professional Staff and Strong Leadership

LPO supports this robust risk management and portfolio monitoring with a talented and dedicated professional staff. The program has recently scaled up its staff to continue to attract quality applications into the active application pipeline and will continue to actively work to ensure sufficient staffing exists to effectively implement and steward taxpayer resources. LPO continues to build a team that includes professionals who understand and can manage project risk in underwriting complex transactions, and can evaluate the technical, legal, and environmental questions that need to be answered before the Department issues a new loan. LPO has a clear leadership structure, including dedicated division directors, to improve accountability, roles, and responsibilities. LPO leadership regularly sets internal strategic goals and targets for management and organizational improvements, updating policies and procedures, staffing, improving information technology systems, and other areas; and they track progress against those targets.

A Healthy Portfolio

Nearly all of these steps in the loan application evaluation process are related to and informed by recommendations like those from the independent Allison Report. And that has allowed the portfolio to grow in a way that takes measured risk to accelerate deployment of innovative technologies in various clean energy sectors and of technologies that increase the manufacturing competitiveness in the domestic supply chain—all while protecting taxpayer dollars.

LPO maintains a healthy loan portfolio concentrated in creditworthy assets, with 70% of exposure held by borrowers with investment-grade ratings (BBB- or higher), and it maintains a low aggregate loss rate of approximately 3% of funds disbursed, as of the end of FY 2022. Of the nearly $31.6 billion disbursed in FY 2022, $13.7 billion in principal was repaid, along with $4.3 billion in interest. To protect against future losses, cumulative through FY 2023, LPO has reserved more than $4.3 billion in credit subsidy to closed loans and realized $1.0 billion in losses, indicating that the office is taking a conservative approach to managing potential project risk. As of the end of FY 2022, every active borrower repaid principal and is current on their obligations. The LPO portfolio also had an internal exposure-weighted average risk rating of ‘BBB-’, improved by one-notch from ‘BB+’ from the end of FY 2021. This is the first time in the LPO portfolio’s history that the overall weighted portfolio rating has reached investment-grade by the end of the fiscal year.

A combination of the robustness of LPO’s underwriting and oversight capabilities, and the conservative approach LPO has taken to selecting and modeling projects and approving financing, has amounted to a healthy, effective portfolio. Given that LPO is designed to support projects that have unique risks that commercial debt markets are either unable or unwilling to address, it should be no surprise if a small number of projects result in losses. However, LPO’s proactive risk and portfolio management approach has been designed to minimize such losses and maximize recovery in the event of a default. As LPO continues to implement its mandate, we look forward to doing so in a transparent and responsible manner.

This blog was updated in October 2023.