Learn more about what it means when the Loan Programs Office offers a conditional commitment for a loan or loan guarantee

Office of Energy Dominance Financing

August 2, 2023

What is a Conditional Commitment?

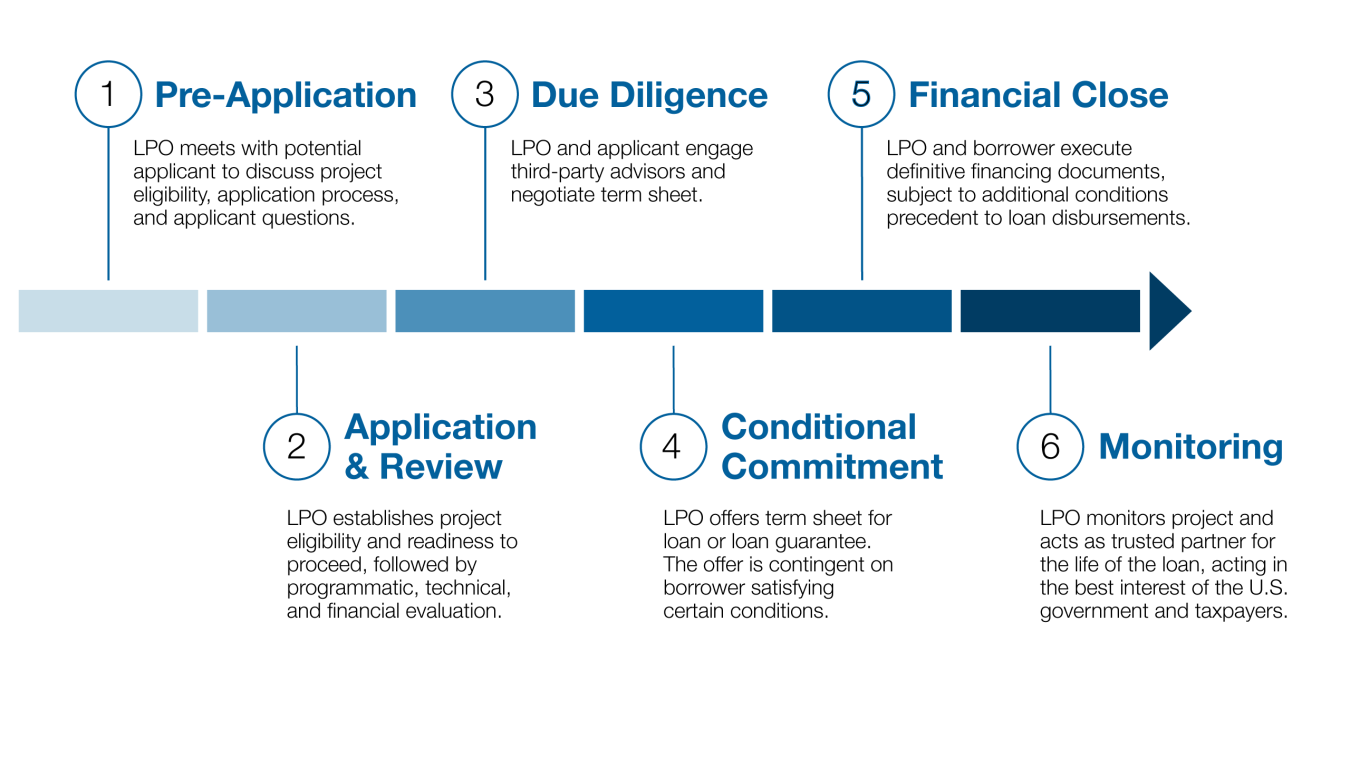

A conditional commitment is an offer approved by the Secretary of Energy to issue a loan or a loan guarantee to a project on the terms and subject to conditions set forth in a term sheet negotiated between DOE and the applicant. The term sheet contains the key financial and commercial terms of the potential loan or loan guarantee, the conditions that must be satisfied prior to the issuance and funding of a loan or loan guarantee, and the ongoing rights and remedies of DOE under the financing documents. The term sheet is approved by DOE, the Office of Management and Budget, and in some cases, the Treasury Department. For Title 17 Projects, the term conditional commitment and related procedures are described further in DOE’s regulations.

Examples of Types of “Conditions Precedent”

The approved term sheet will specify additional steps the borrower must take to proceed toward financial close on the loan or loan guarantee, which include fulfilling particular legal, technical, commercial, contractual, and financial requirements; completion of satisfactory due diligence, the absence of a material adverse change or material litigation affecting the project, and the negotiation and execution of definitive financing documents acceptable to DOE. These requirements are often referred to as conditions precedent.

Conditions precedent often require that the borrower address or mitigate various risks associated with the loan, and they are established by DOE in the term sheet to help ensure the borrower’s ability to meet a reasonable prospect of repaying the loan. Examples of some of the types of conditions precedent may include, but are not limited to, requiring the borrower to demonstrate that they have met certain financial or equity obligations, complete the required environmental permitting for the project, or attain engineering or manufacturing performance or quality expectations, among other factors. To protect taxpayer resources, these or other types of conditions are often structured so they have to be met prior to loan closing, and / or prior to first and subsequent advances of loan proceeds.

Financial Close

No funds are disbursed to a project until the DOE, the applicant, and related project or financing parties have completed definitive financing documents and the requirements for financial close, including meeting all conditions to disbursement as specified in the loan or loan guarantee agreement. The time between conditional commitment and financial close varies by project.

After a loan closes, LPO’s Portfolio Management Division leads the loan monitoring process through the end of the loan term. This includes monitoring project cash flows to ensure debt repayment and reporting portfolio performance regularly.

Although the vast majority of the conditional commitments issued by DOE result in a loan or loan guarantee, certain applicants do not meet the conditions precedent. In those situations, the project ultimately does not proceed to financial close.

Learn more about LPO’s application process and request a pre-application consultation to learn more about how your project might qualify for financing.

This page was last updated on March 17, 2025.