Overview

The following overview summarizes the Title 17 Energy Financing Program. For detailed information on the Energy Financing Program, please refer to:

- Title 17 Program Guidance: This Guidance provides a comprehensive program overview.

- Part I and Part II Application Instructions

- Title 17 Interim Final Rule: The Rule amends Title 17 regulations to implement changes that expand or modify program authority and to revise for clarity and organization.

- Governing Documents: LPO's programmatic governing documents detail statutory and legislative framework (e.g., foundational legislation, rules, and documents; appropriations; interagency requirements; environmental compliance; federal credit programs).

- Title 17 Overview Handout, Innovative Handout, SEFI Handout and SEFI Toolkit, EIR Handout: These resources summarize program offerings and requirements.

- Title 17 Frequently Asked Questions

Under the Title 17 Energy Financing Program, LPO can finance projects in the United States that support clean energy deployment and energy infrastructure reinvestment. Title 17 was created by the Energy Policy Act of 2005 and has since been amended, most recently by the Infrastructure Investment and Jobs Act in 2021 and the Inflation Reduction Act in 2022. The legislation expanded the scope of Title 17 to include certain state-supported projects and projects that reinvest in legacy energy infrastructure, and it leverages additional loan authority and funding available for projects involving innovative energy technologies.

There are four project categories within the Title 17 Energy Financing Program:

Innovative Energy: Financing for projects that deploy New or Significantly Improved Technology that is technically proven but not yet widely commercialized in the United States. (See page 15 of the Title 17 Program Guidance or the Title 17 Interim Final Rule for a definition of New or Significantly Improved Technology.)

Innovative Supply Chain: Financing for projects that employ a New or Significantly Improved Technology in the manufacturing process for a qualifying clean energy technology or for projects that manufacture a New or Significantly Improved Technology.

State Energy Financing Institution (SEFI)-Supported: Financing for projects that support deployment of qualifying clean energy technology and receive meaningful financial support or credit enhancements from an entity within a state agency or financing authority.

Energy Infrastructure Reinvestment (EIR): Financing for projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations or upgrade operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or greenhouse gas emissions.

Through the Title 17 Energy Financing Program, borrowers can access:

- Direct loans from U.S. Treasury’s Federal Financing Bank (FFB) backed by 100% “full faith and credit” DOE guarantees, OR

- DOE partial guarantees of commercial debt

Interest Rate: For FFB loans backed by a DOE loan guarantee, the interest rate is: U.S. Treasury curve, plus a liquidity spread equal to “three-eighths” (0.375%), plus a risk-based charge:

- The Treasury rate is fixed at the day or days the funds are drawn, according to loan tenor.

- LPO may buy down the risk-based charge for certain projects.

Eligibility

The Title 17 Energy Financing Program project categories share six key eligibility criteria. Each category also carries additional requirements.

The value of partnering with LPO through the Title 17 Energy Financing Program

- Access to patient capital: LPO can provide access to debt capital for large-scale energy or energy infrastructure reinvestment projects that other lenders might not provide.

- Detailed technical due diligence: LPO bases the financing terms on thorough technical analysis of the specific project and technologies in question. Often, the result is attractive financing that increases commercial lenders’ confidence in LPO-financed technologies and project structures.

- Flexible, custom financing: Options include limited recourse project financings, secured corporate lending, securitizations, transactions involving tax equity, and other deal structures. LPO can finance large projects as a sole lender (FFB loan; DOE guarantee), fill gaps in financing as part of a group of lenders (FFB loan; DOE guarantee), or offer a partial guarantee commercial debt.

- Committed partnership and specialized expertise: LPO brings a team of in-house financial, technical, legal, and environmental professionals with expertise in first-of-kind projects and a variety of deal structures. LPO remains a partner for the life of the loan.

Costs and Fees

- No application fees

- External advisor fees: Payable directly to advisors starting at due diligence; an eligible project cost financeable by LPO. Expenses accrue and typically range from $1 million to $3 million for deals that reach financial close. The applicant is responsible for accrued third-party fees regardless of whether the deal reaches financial close.

- Facility fee: Due at financial close; an amount equal to 0.6% of the portion of the principal amount of the guaranteed obligation that does not exceed $2 billion, plus 0.1% of the portion of the principal that exceeds $2 billion.

- Maintenance fees: Due annually after financial close; the amount of the Maintenance Fee is typically in the range of $150,000 to $200,000 per calendar year, although can be up to $500,000 per year depending on the complexity of the loan.

While there is no minimum eligible project size, LPO typically finances projects of $100 million or more due to the fixed costs associated with the application process and loan monitoring.

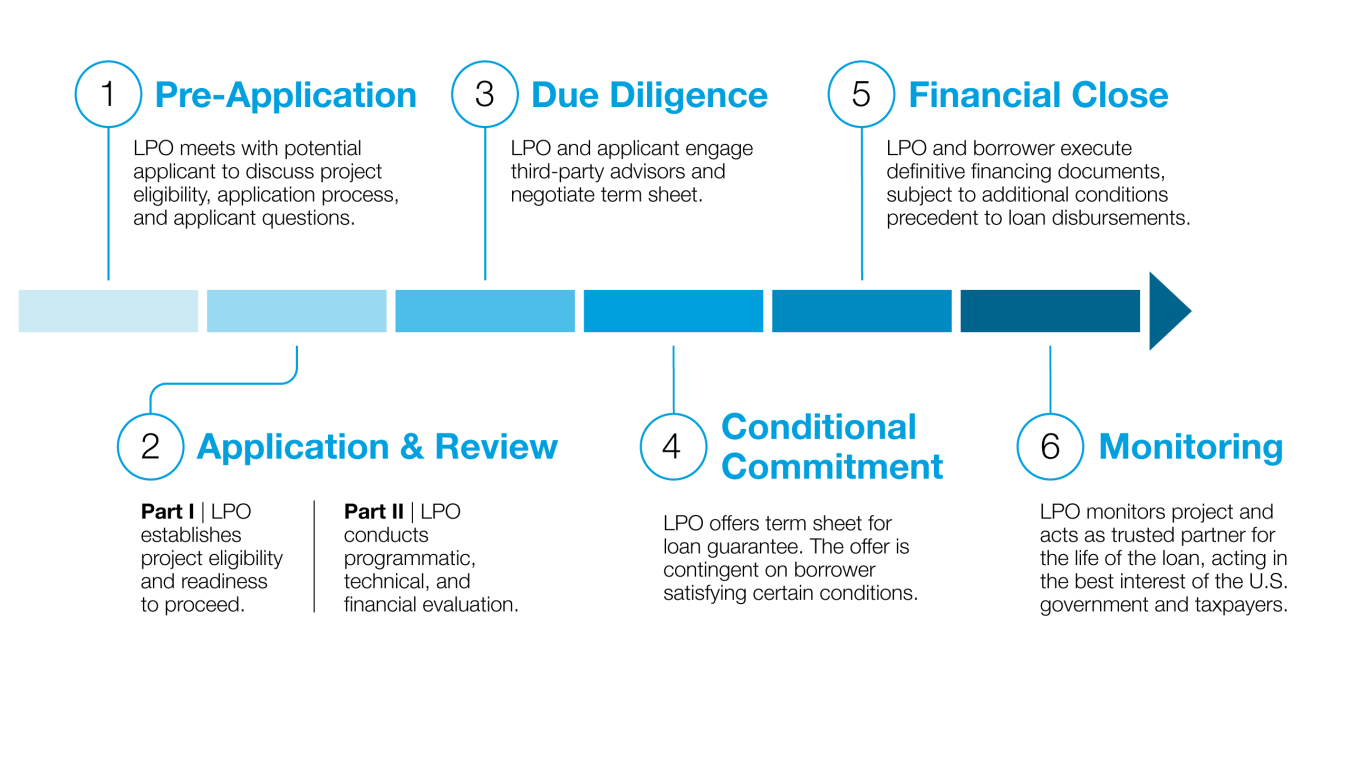

Application Process

The application process is standard across the four Title 17 project categories and is designed to identify strong candidates for LPO financing, support them in preparing comprehensive applications, and assess the risk and value of the proposed projects. The duration varies based on the applicant’s level of preparation and project complexity, but it typically takes a minimum of six months to more than a year.

Title 17 application requirements are described in the following documents.