WHO WE ARE

The Department of Energy’s Loan Programs Office (LPO) provides attractive debt financing for high-impact, large-scale energy infrastructure projects in the United States.

LPO has issued tens of billions of dollars in strategic debt financing to transform the energy and transportation economy to benefit Americans. Our loans helped launched the utility-scale solar and wind industries in America, have expanded domestic manufacturing of electric vehicles, and are reviving nuclear energy in the United States.

MISSION

LPO’s mission is to be the premier public financing partner that accelerates high-impact energy and manufacturing investments to advance America’s economic future.

MANDATE

Our mandate is to administer loan programs that:

- Provide a bridge to bankability for large-scale, high-impact clean energy and supply chain projects that help energy technologies deploy at scale and advance America’s energy and economic future.

- Enable expansion of America’s domestic energy manufacturing by meaningfully advancing energy and supply chain projects that support, onshore, or reshore supply chains projects; build a domestic energy workforce; and bolster American supply chain competitiveness.

- Make the clean energy transformation affordable and achievable for workers, consumers, and communities by creating quality jobs in domestic clean energy industries, promoting energy affordability, and ensuring all energy communities stand to benefit from the clean energy transformation.

LOAN PROGRAMS

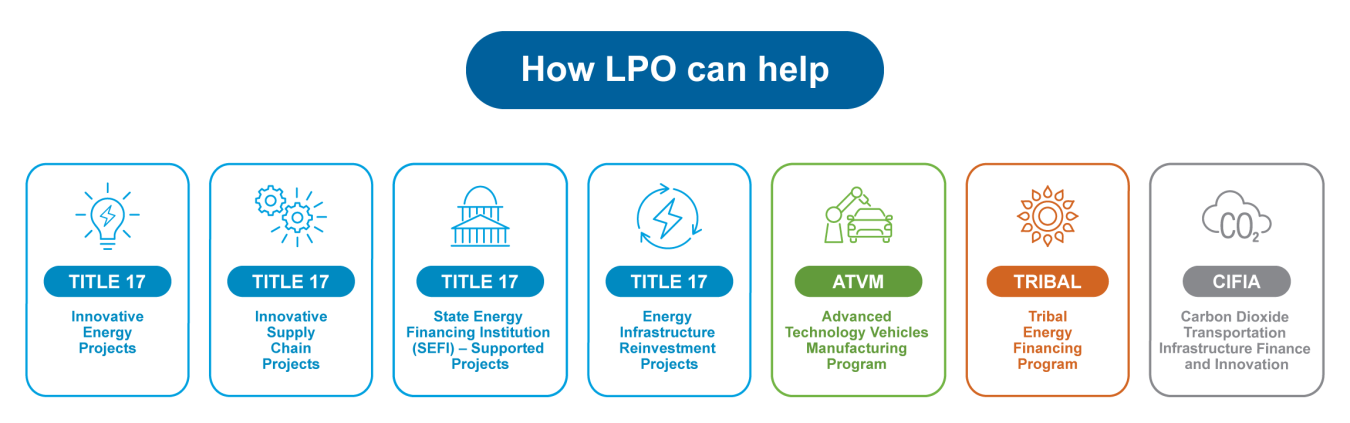

LPO financing programs support projects across the energy and advanced transportation sectors.

Title 17 Clean Energy Financing Program (Title 17): Financing to support clean energy deployment and energy infrastructure reinvestment to reduce greenhouse gas emissions and air pollution. Title 17 includes four project categories, each with a specific focus:

- Innovative Energy: Financing for projects that deploy New or Significantly Improved Technology.

- Innovative Supply Chain: Financing for projects that employ a New or Significantly Improved Technology in the manufacturing process for a qualifying clean energy technology or for projects that manufacture a New or Significantly Improved Technology.

- State Energy Financing Institution (SEFI)–Supported: Financing for projects that support deployment of qualifying clean energy technology and receive meaningful financial support or credit enhancements from an entity within a state agency or financing authority.

- Energy Infrastructure Reinvestment: Financing for projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations or upgrade operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or greenhouse gas emissions.

Advanced Transportation Vehicle Manufacturing Program (ATVM): Loans to support the manufacturing of eligible vehicles and qualifying components.

Tribal Energy Financing: Financing to support tribal investment in energy-related projects.

Carbon Dioxide Transportation Infrastructure Finance and Innovation: Financing for large-capacity, common-carrier carbon dioxide (CO2) transport projects.

LEARN MORE

Read more about LPO's Leadership, History, Portfolio, and the Technology Sectors we support, as well as our Good Governance, Values, and Code of Conduct.