Utility Program Navigator

See a list of utility tariffs and programs offered by vertically integrated utilities.

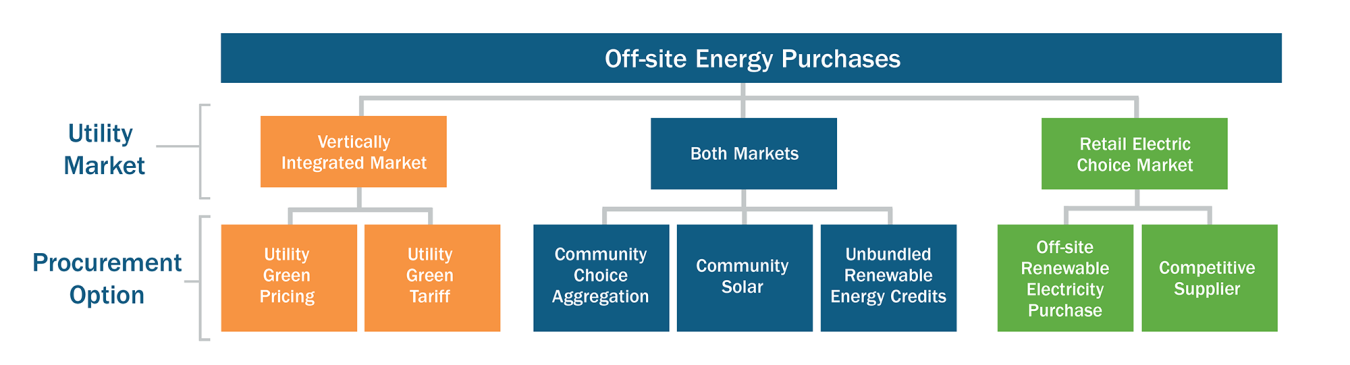

Federal agencies can pursue many types of off-site electricity procurement options, which vary in availability and their product characteristics across the country. Different options are available depending on the type of electricity market. While the serving utility is responsible for generation, transmission, and distribution in a vertically integrated market, in retail electric choice markets, most consumers can choose their electricity supplier.

Determining sites' electricity market type is an important first step to identifying the available off-site purchasing options. Below is a brief description of the two electricity market types.

For further assistance in identifying a site’s electricity market type and evaluating off-site purchasing options, submit a request through the Technical Assistance for Distributed Energy Projects portal. The Federal Energy Management Program (FEMP) also supports federal agencies with on-site distributed energy procurement options.

In vertically integrated markets, the General Services Administration (GSA) has established areawide contracts (AWC) with utility service suppliers to cover utility service needs of Federal agencies within the franchise territory of the supplier.

GSA is authorized by 40 U.S.C. 501 (FAR Part 41) to prescribe policies and methods governing the acquisition and supply of utility services for Federal agencies. GSA has delegated this authority to the Department of Defense (DOD), including DLA Energy, and Department of Energy (DOE), as well as the Department of Veteran Affairs (VA) for connection charges only.

If GSA has not established an AWC in the utility service territory of an agency site, then the agency must request a delegation of authority from GSA. Initiating a request for a delegation of authority can be sent to

In retail electric choice markets, customers can choose their electricity supplier. View which states have complete or partial retail electric choice.

As in the vertically integrated markets, GSA is authorized by 40 U.S.C. 501 (FAR Part 41) to prescribe policies and methods governing the acquisition and supply of utility services for Federal agencies. GSA has delegated this authority to the DOD, including DLA Energy, and DOE. Due to multiple available electric suppliers, the procurement of utility services is conducted through a competitive process.

Email both DLA Energy and GSA for assistance in retail electric choice markets, as they can coordinate opportunities to aggregate federal requirements and obtain competitive pricing.

Considerations for Renewable Energy Purchases

In accordance with the Energy Policy Act of 2005 (EPAct 2005), federal agencies are required to source at least 7.5% of their electricity from renewable sources. EPAct 2005 defines the following sources as renewable: solar, wind, geothermal, hydrokinetic, biomass, landfill gas, municipal solid waste, and new hydropower or hydropower that improves efficiency or provides additional capacity at existing plants. Please refer to Federal Renewable Energy Use Requirement for additional information.

For all planned purchases of renewable energy, regardless of market, the agency Contracting Officer should be consulted early in the process. Agencies are not allowed to use FAR Part 41 (except under the GSA AWC) unless the agency has received a delegation of authority from GSA to acquire utility services. GSA and DOD's authority may vary for each of these purchases.

Agencies should pursue energy efficiency as the first step in their energy procurement assessments, as it reduces the amount of electricity required. For renewable energy purchases, it is important to understand the ownership of renewable energy certificates (RECs), also known as energy attribute certificates (EACs). RECs represent the environmental attributes of 1 MWh of power produced from renewable energy projects and can be sold separately from electricity.

More information on RECs can be found on the U.S. Environmental Protection Agency's (EPA) Green Power Markets website, including REC price information. EPA Green Power historical pricing is also available.

Other important considerations include:

- Agency electricity targets and goals

- Cost savings potential

- Ease of participation

- Price stability

- Contract length

- Choice of resource

- Contracting officer availability.

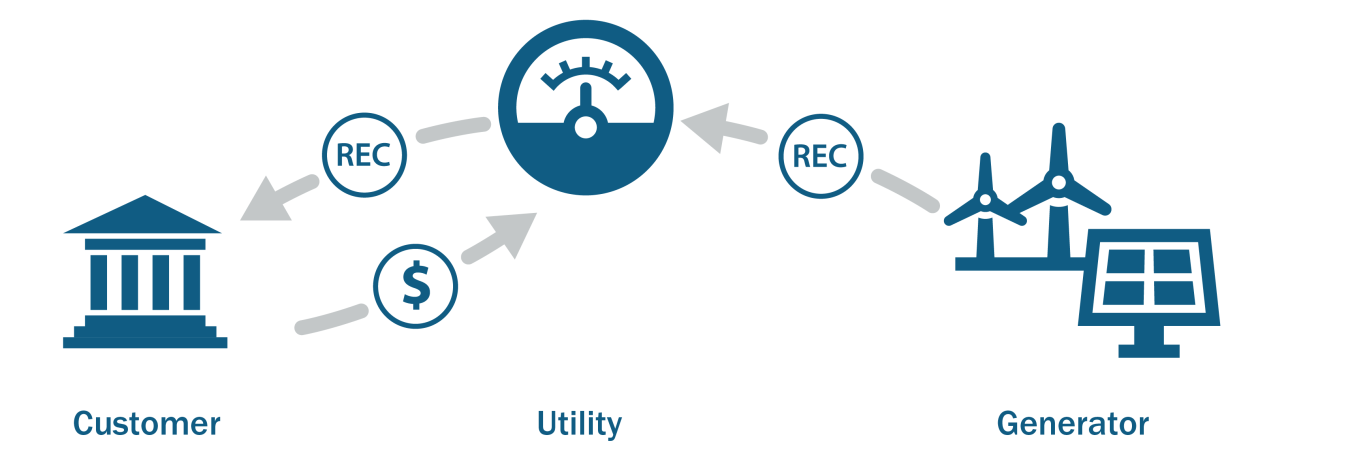

Utility Green Pricing

These products are usually month-to-month options offered at a price premium on existing electricity bills, with the utility sourcing these products from either a utility-owned renewable energy asset or a third-party-owned renewable energy project in the local grid. In some cases, the utility may buy unbundled RECs or EACs from a project outside their regional grid.

- Market Type: These products are offered by utilities in vertically integrated markets. They may also be offered by public utilities such as cooperatives and municipal utilities in states with retail electric choice markets.

- Cost Savings Potential: None, average premium is 1.5 cents/kWh

- Contract Length: Shorter contract terms (e.g., month-to-month)

- Choice of Generating Technology: None, utility determines technology mix

- EAC Ownership: The EACs are typically conveyed to the buyer or retired on their behalf

- Additional Resources: Visit NLR's utility green pricing program list for available green pricing programs.

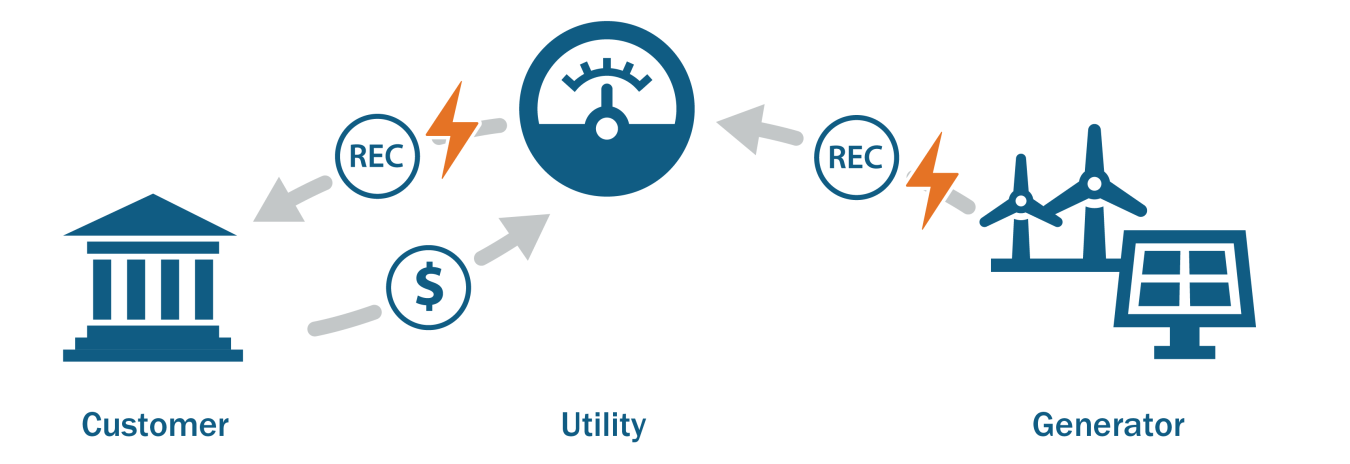

Utility Green Tariff

Under a utility green tariff, the customer enters into a contract with the utility to procure both electricity and EACs from a renewable energy project. The project may be utility- or third-party-owned. The contracts are usually longer-term and may offer the ability to save money over time. FEMP can assist federal agencies in understanding the details of specific products, especially since the payment structure for these products varies.

- Market Type: These products are offered by utilities in vertically integrated markets. They may also be offered by public utilities such as cooperatives and municipal utilities in states with retail electric choice markets.

- Cost Savings Potential: Possible, depending on the structure and term

- Contract Length: Longer agreements often required (10-20 years)

- Choice of Generating Technology: Customers may have input

- EAC Ownership: The EACs are typically provided to the customer

- Additional Resources: The Clean Energy Buyers Association provides a report with a map of green tariff availability, a report on green tariff details, and summary of contracts signed over time. For more information on utility green tariffs, visit the EPA Green Power Markets website.

Competitive Supplier

GSA and DLA Energy purchase electricity on behalf of federal agencies in the majority of these markets. The distribution utility remains responsible for transmission and distribution service.

- Market Type: Retail electric choice markets

- EACs bundled with Electric Supply: Yes, if requested

- Cost Savings Potential: Yes

- Contract Length: 2-5 years

- Additional Resources: Additional information is available on the EPA Green Power Partnership website and the National Laboratory of the Rockies website.

Email both GSA and DLA Energy to find out whether they already purchase electricity for your site and if not, information regarding how to join their aggregated procurements.

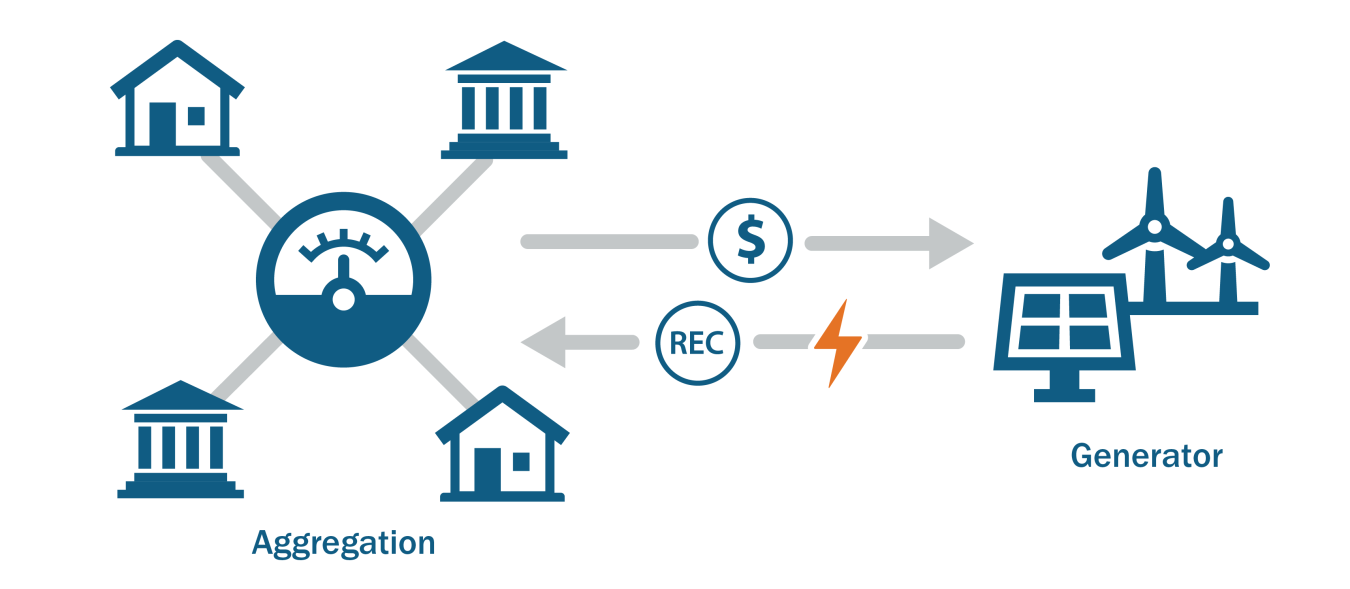

Community Choice Aggregation (CCA)

Community Choice Aggregators (CCAs) are suppliers that buy electricity for their local community; with some offering a unique grid-supplied renewable energy mix and discrete off-site purchased renewable energy options. Under a CCA, customers obtain their electricity supply from the CCA, and their investor-owned utility maintains responsibility for transmission and distribution service to their site. In some cases, the CCA may buy unbundled EACs from a project outside their regional grid.

- Market Type: Both vertically integrated and retail electric choice. As of April 2022, eight states (California, Illinois, Massachusetts, New Jersey, New York, Virginia, Ohio, and Rhode Island) have established community choice aggregation programs, although their program specifics vary considerably.

- Cost Savings Potential: Yes

- Contract Length: Shorter contract terms (e.g., month-to-month)

- Choice of generating technology: No. Determined by the CCA.

- EAC Ownership: RECs and EACs are often retired by the CCA in states with renewable standards on behalf of customers. Off-site purchased options in CCA states like California can offer EAC retirements for subscribers.

- Additional Resources: For information on CCA development, check LEAN Energy US. Confirm with your utility that a CCA is available in your area and that your site is eligible to participate.

Community Solar

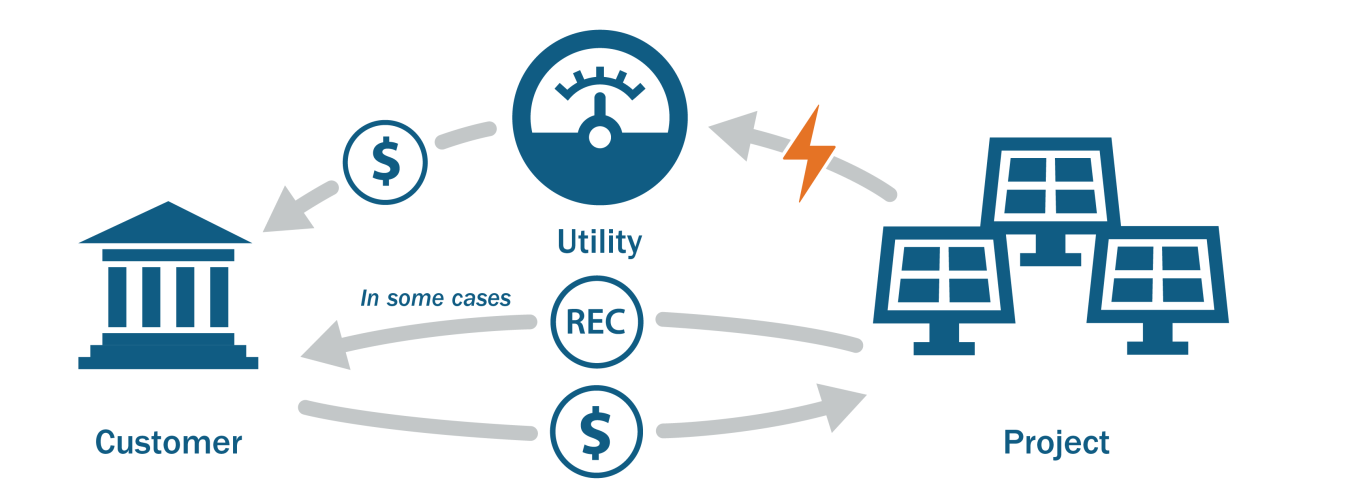

Under a community solar program, a subscriber pays for a share of the electricity from a large solar array, then receives a bill credit for the electricity production from their share. In many cases, a third-party owns the solar array and manages the subscription rather than the utility or electric supplier. The utility usually provides the bill credit on the customer’s utility bill.

- Market Type: Both vertically integrated and retail electric choice markets

- Cost Savings Potential: Possible

- Contract Length: Typically, longer agreements (10-20 years)

- Choice of generating technology: Solar only

- EAC ownership: Subscribers do not typically receive the associated EACs

- Additional Resources: Check NLR's community solar project listings and your local utility and state community solar listings. States with established community solar markets may provide lists of community solar projects.

Off-Site Renewable Electricity Purchase

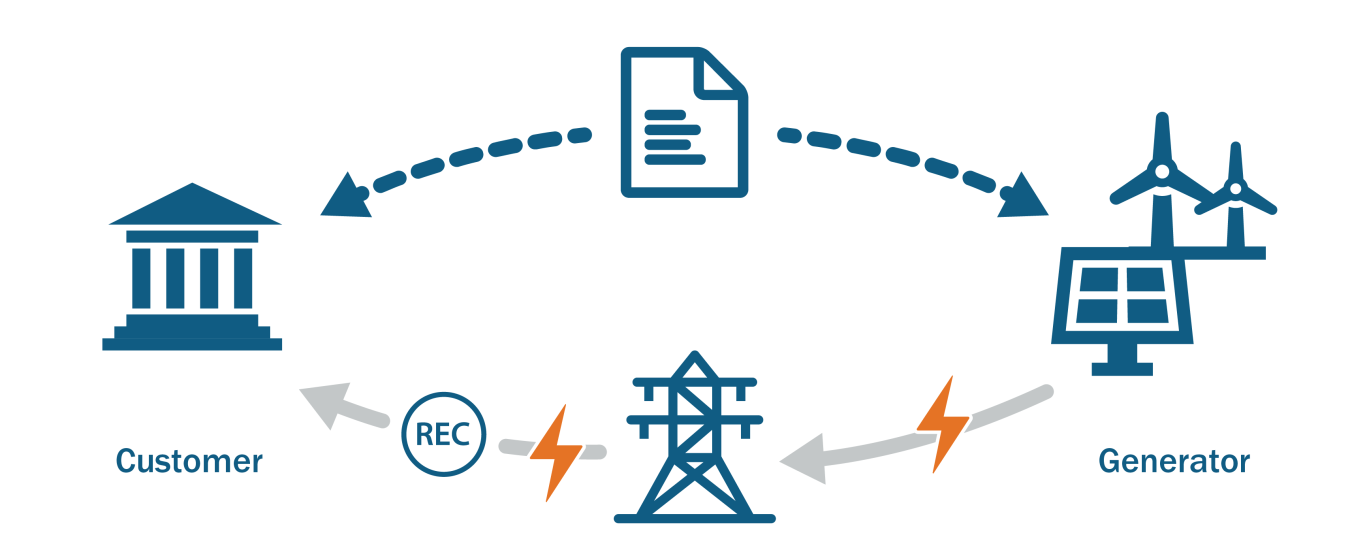

Under these contracts, the buyer typically agrees to purchase electricity from a renewable energy provider that is not the utility. The buyer must work with the utility for ensuring the delivery of the electricity.

- Market Type: Retail electric choice markets

- Cost Savings Potential: Yes

- Contract Length: Longer agreement (10-20 years)

- Choice of generating technology: Yes

- EAC Ownership: Negotiable in contract

- Additional Resources: Agencies should contact FEMP for additional information on the different procurement vehicles available to the federal government. Agencies should contact GSA and/or DLA Energy to find out whether there are opportunities to join an aggregated procurement.

Unbundled Renewable Energy Credits (RECs)

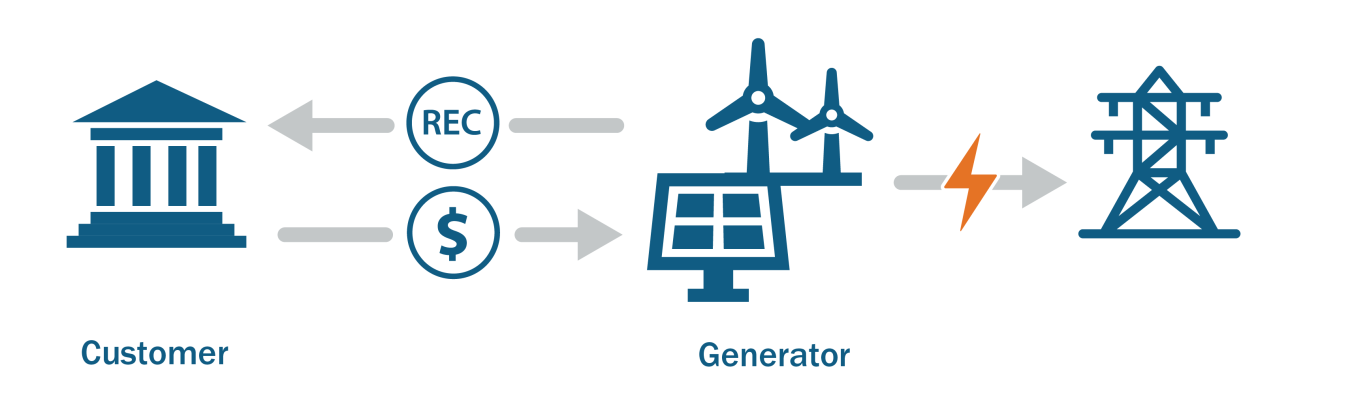

Agencies purchase RECs from projects, typically through a third-party REC marketer. The EACs are "unbundled" from the electricity, and may not be generated in the agency’s utility service territory.

- Market Type: Both traditionally-regulated and competitive markets

- Cost Savings Potential: No

- Contract Length: Shorter contracts (typically 1-3 years)

- Choice of generating technology: Yes

- EAC Ownership: Yes

- Additional Resources: DLA Energy allows federal customers to utilize their Basic Ordering Agreements to procure unbundled EACs. Additional EAC information, including historical prices, is available on the EPA Green Power Markets website.