SUBSCRIBE to the Fact of the Week

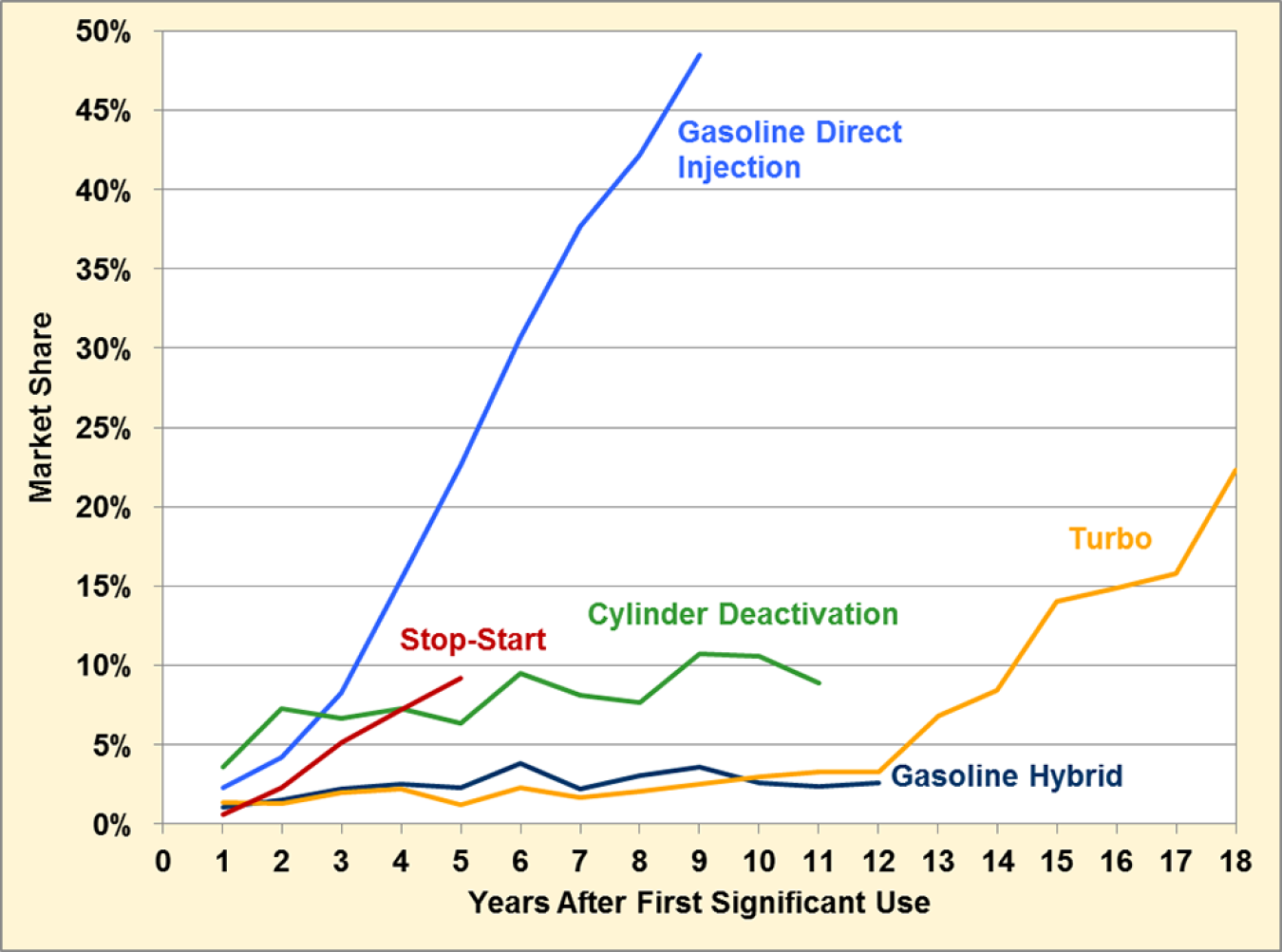

Gasoline direct injection (GDI) has seen rapid adoption since its first significant use. Many auto manufacturers have used the combined benefits of GDI and turbocharging for increasing power output from downsized engines. This is evident in the rapid rise of turbo-charged engines in the last five years shown. Cylinder deactivation, which is seen mostly in 6- and 8-cylinder applications, has about 10% market share over the past five years. Stop-start technology in non-hybrid vehicles is relatively new in the U.S. market and has only been around for five years since its first significant use. However, in just five years, stop-start has reached over 9% market share while gasoline hybrids have only grown to 4% market share in the past 12 years.

New Technology Penetration in Light Vehicles (percentage of new vehicle sales)

Note: Stop-start technology data are for non-hybrid vehicles. First significant use generally represents a production threshold of about 1%, though in some cases, where full data is not available, first significant use represents a slightly higher production share.

Supporting Information

New Technology Penetration in Light Vehicles (Light Vehicle Market Share)

| First Significant Use (Years) | Turbo | Gasoline Hybrid | Cylinder Deactivation | Gasoline Direct Injection | Non-Hybrid Stop-Start |

|---|---|---|---|---|---|

| 1 | 1.4% | 1.1% | 3.6% | 2.3% | 0.6% |

| 2 | 1.3% | 1.5% | 7.3% | 4.2% | 2.3% |

| 3 | 2.0% | 2.2% | 6.7% | 8.3% | 5.1% |

| 4 | 2.2% | 2.5% | 7.3% | 15.4% | 7.2% |

| 5 | 1.2% | 2.3% | 6.4% | 22.6% | 9.2% |

| 6 | 2.3% | 3.8% | 9.5% | 30.7% | |

| 7 | 1.7% | 2.2% | 8.1% | 37.7% | |

| 8 | 2.1% | 3.1% | 7.7% | 42.2% | |

| 9 | 2.5% | 3.6% | 10.7% | 48.5% | |

| 10 | 3.0% | 2.6% | 10.6% | ||

| 11 | 3.3% | 2.4% | 8.9% | ||

| 12 | 3.3% | 2.6% | |||

| 13 | 6.8% | ||||

| 14 | 8.4% | ||||

| 15 | 14.0% | ||||

| 16 | 14.9% | ||||

| 17 | 15.8% | ||||

| 18 | 22.3% | ||||

Note: Market share is based on light vehicle production. | |||||