The current solar supply chain is global but is dominated by products from China or companies with close ties to China. The U.S. government is using tools like tariffs, duties, tax credits, and loans to support domestic manufacturers in competing with foreign products and growing the U.S. supply chain. Building a U.S. solar supply chain could mitigate global supply chain challenges, benefit the U.S. economy, and lead to a more secure, affordable, and reliable electricity supply.

What is the Solar Supply Chain?

Solar photovoltaic (PV) manufacturing involves making a wide variety of products and materials across several manufacturing steps, often done in different locations. In the United States, there are two leading types of solar panels: cadmium telluride (CdTe) and crystalline silicon (c-Si). Across the two types, some of the manufacturing steps described below are shared and some are different. The figure below shows the supply chain segments for c-Si solar panels.

Polysilicon

Polysilicon is fine-grain silicon with a minimum purity level of 99.999999 percent. Polysilicon is used to make monocrystalline silicon ingots, which are sliced to make wafers.

c-Si Wafer

A wafer is a thin slice or layer of very pure semiconductor material used to make a PV cell. When exposed to sunlight, PV semiconductors absorb the light and produce electricity. c-Si wafers are made by thinly slicing monocrystalline silicon ingots, which are grown from molten polysilicon.

c-Si Cell

A PV cell is the smallest part of a solar module that turns light into usable electricity. c-Si cells are made from c-Si wafers through a series of chemical and thermal treatments and adding metal contacts.

PV Module

A PV module is a finished product that converts sunlight into electrical energy. PV modules are made by connecting dozens of PV cells and then sandwiching them between layers of plastic and glass. They can be made of a variety of cell types, but the most common in the United States are c-Si and CdTe.

Balance of Module

Balance of module refers to all the other parts of a PV module, excluding the cells. This includes solar glass, encapsulant, backsheet, one or two junction boxes, and a metal frame or backrails.

PV Mounting System

The PV mounting system holds PV modules in place, securing them from wind and allowing for air circulation to keep them cool. The two main types are racking systems, which keep PV modules fixed at certain angles on the ground or rooftops, and tracking systems, which rotate the PV modules to follow the sun throughout the day. Both system types are made from support posts, rails, structural fasteners, and torque tubes.

PV Inverter

An inverter converts the electrical output from solar modules from direct current to alternating current, making it compatible with the electrical grid.

PV Manufacturing Equipment

PV manufacturing equipment refers to the tools and machines, like ingot pullers, cell stringers, and busbar tabbers, that are used to make products along the solar supply chain.

See which solar manufacturing steps are being done in the United States today in our solar manufacturing map.

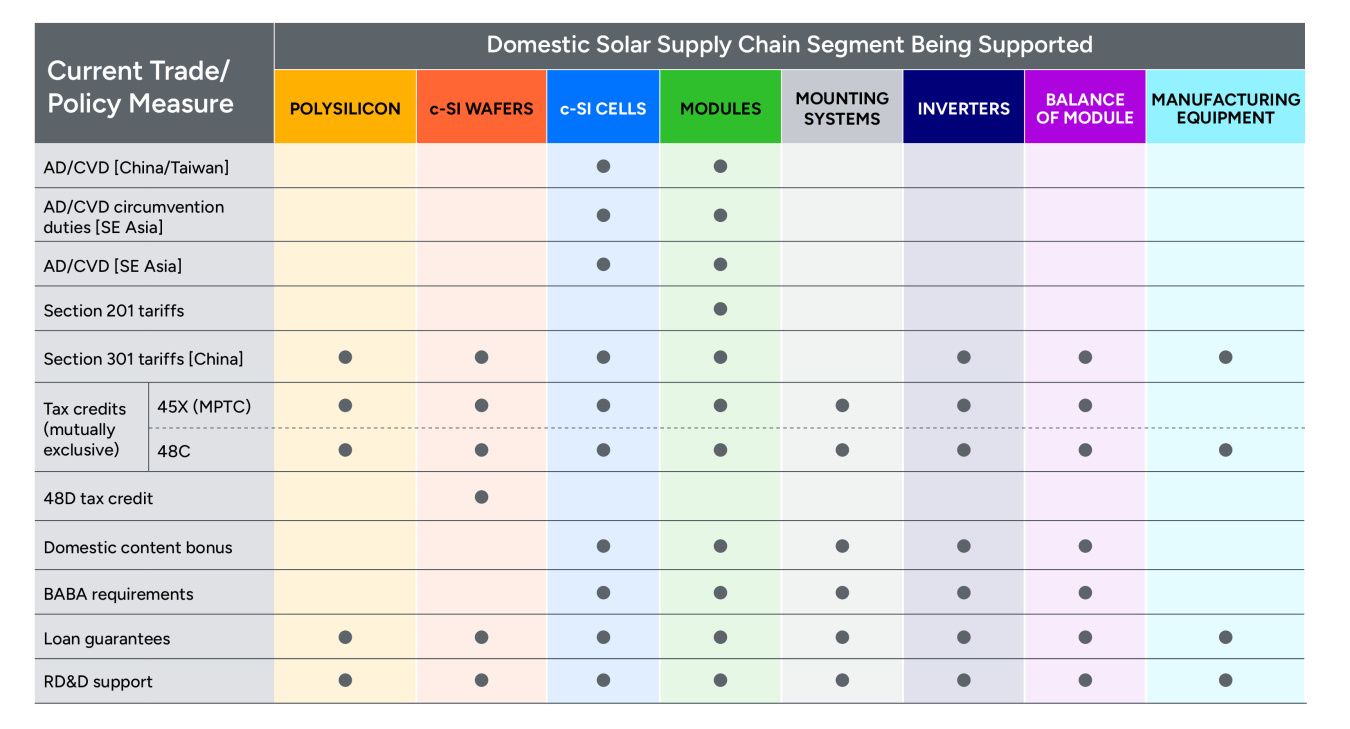

What Trade Measures Exist Today?

A variety of trade measures impact the growth of U.S. solar manufacturing, targeting both domestic and foreign stakeholders at different points in the supply chain.

Antidumping and Countervailing Duties (AD/CVD)

Antidumping and countervailing duties (AD/CVD) are fees collected by U.S. Customs and Border Protection on imported goods in response to a determination by the U.S. Department of Commerce that the goods were sold unfairly. “Dumping” happens when a foreign company sells a product in the United States below its production costs. A “countervailable subsidy” is when a foreign government provides financial assistance to foreign producers that is deemed unfair. In general, AD/CVD are intended to protect domestic producers from unfair foreign prices. The U.S. Department of Commerce sets duty rates, which can vary by year and by company.

AD/CVD (China and Taiwan)

In 2012, the U.S. Department of Commerce placed AD/CVD on c-Si solar modules and cells coming from China, and it added Taiwan in 2014. These duties normally last five years, but Commerce has extended the length of these orders twice —most recently in 2024.

AD/CVD Circumvention Duties (Southeast Asia)

In 2023, the U.S. Department of Commerce found that some companies in Vietnam, Malaysia, Thailand, and Cambodia were circumventing the AD/CVD on Chinese c-Si solar modules and cells. If products from these countries use Chinese wafers and more than two other Chinese-made components (like silver paste, aluminum frames, glass, backsheet, ethylene vinyl acetate sheets, and junction boxes), they are deemed to be circumventing Chinese AD/CVD. The U.S. Department of Commerce started collecting these duties in June 2024.

AD/CVD (Southeast Asia)

In June 2024, the U.S. International Trade Commission found that imports of c-Si cells and modules from Vietnam, Malaysia, Thailand, and Cambodia may be harming the U.S. solar panel manufacturing industry. The U.S. Department of Commerce began an AD/CVD investigation of these imports in May 2024. In the fall of 2024, Commerce placed preliminary AD and CVD on companies in all four countries, with final findings expected in early 2025.

Section 201 Tariffs

Section 201 tariffs are fees collected by U.S. Customs and Border Protection on imported goods to give domestic industries time to become competitive. The president, with advice from the U.S. Trade Representative, determines whether the domestic industry requires temporary protections. In 2018, President Trump placed Section 201 tariffs on imported c-Si cells and modules. These tariffs were extended for another four years in 2022 and will end in February 2026. The first 12.5 GW of cells imported annually are exempt from Section 201 tariffs so that they can be used to assemble solar panels domestically.

Section 301 Tariffs (China)

Section 301 tariffs are fees collected by U.S. Customs and Border Protection on imported goods that violate trade agreements or benefit from unfair trade practices. The president, with advice from the U.S. Trade Representative, determines whether these practices unfairly burden U.S. commerce. Since 2018, the U.S. government has placed Section 301 tariffs on many Chinese products, including polysilicon, solar wafers, solar cells, solar modules, inverters, and other balance-of-module components. In 2024, it raised the tariffs on semiconductors, solar modules, solar cells, wafers, and polysilicon to 50% while granting some solar manufacturing equipment a temporary exemption.

Summary of Trade and Policy Measures by Supply Chain Segment

Additional Information

- Learn the basics of solar manufacturing.

- Dive deep into our Solar Photovoltaics Supply Chain Review report.

- Subscribe to the SETO newsletter to keep up with the latest solar news and funding opportunities.