Since President Biden delivered the Bipartisan Infrastructure Law on November 15, 2021, LPO has made significant strides in financing large-scale, all-of-the-above energy infrastructure projects in the United States.

Office of Energy Dominance Financing

November 14, 2023Since President Biden signed the Infrastructure Investment and Jobs Act (IIJA)—more commonly known as the Bipartisan Infrastructure Law (BIL)—on November 15, 2021, the DOE Loan Programs Office (LPO) has made significant strides in advancing its mission to finance large-scale, all-of-the-above energy infrastructure projects in the United States. LPO projects have also supported the Biden-Harris Administration’s commitment to create good-paying jobs and local economic growth across the country, especially in underserved and traditional energy communities and Tribes, and increase efforts to achieve environmental justice.

Following are insights into how the BIL—a key piece of the President's Investing in America agenda—has expanded LPO’s work.

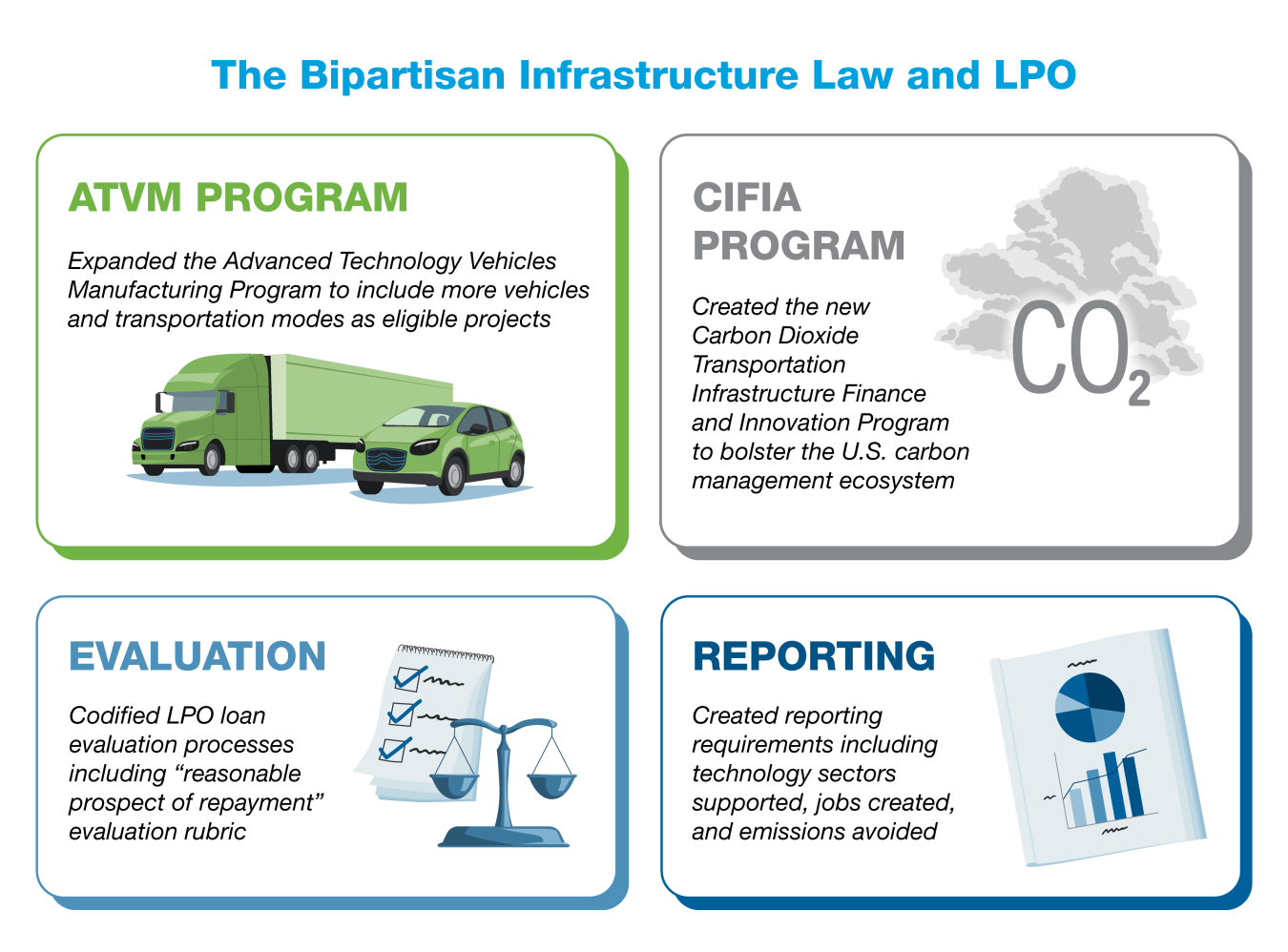

BIL expanded LPO’s Advanced Technology Vehicles Manufacturing Loan Program.

In addition to light-duty and ultra-efficient vehicles manufacturing facilities, which have long been eligible for consideration by the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program, the BIL extended that eligibility to certain medium- and heavy-duty vehicles (MHDV) as well as for other transportation modes (e.g., locomotives, maritime vessels including offshore wind vessels, aviation, hyperloop). These additional authorities were funded by the appropriation of $3 billion in credit subsidy to support new ATVM loans, associated with an estimated $40 billion in new ATVM loans to eligible projects.

Learn more about LPO’s ATVM Loan Program and the projects that have qualified for LPO conditional commitments since the passage of the BIL, such as BlueOval SK, CelLink, KORE Power, Redwood Materials, and others.

BIL authorized LPO’s new Carbon Dioxide Transportation Infrastructure Finance and Innovation Program.

Administered jointly with the Office of Fossil Energy and Carbon Management (FECM), the Carbon Dioxide (CO2) Transportation Infrastructure Finance and Innovation (CIFIA) Program was established by IIJA (Title 3, Section 40304). Through CIFIA, DOE can:

- Support loans, loan guarantees, grants, and administrative expenses to enable deployment of common carrier CO2 transportation infrastructure.

- Support a wide range of projects related to clean energy, energy efficiency, and sustainable infrastructure.

- Inspire job creation across various technology sectors.

In October 2022, LPO released Program Guidance on CIFIA. In August 2023, FECM also issued the CIFIA Future Growth Grant NOI. Learn more about LPO’s CIFIA Program.

BIL clarified and codified certain LPO loan evaluation processes.

For example, BIL put into statute the evaluation elements for the reasonable prospect of repayment as a condition of loan approval. This is fully consistent with LPO’s continued practice of assuring that each project proposed to be financed can repay the loan even after LPO weighs the risks inherent in the mandate to finance ATVM and first-of-a-kind energy technologies, as well as other risks associated with the project. BIL also aligns statute with LPO’s current practice of ensuring political influence does not impact project selection.

Along with the Energy Act of 2020, BIL included reporting requirements on metrics.

These metrics include:

- The types of technologies supported by LPO projects.

- Jobs created associated with projects.

- An estimate of avoided pollution or emissions.

- And other factors that ensure informed environmental decisions for communities.

Most of these statistics are tracked in LPO’s Annual Portfolio Status Report. They continue to demonstrate the value of LPO to the taxpayer, to industry, and to the Biden-Harris Administration's climate goals.

* This blog is a part of the Getting to Know LPO series, which provides more information about the role of the Loan Programs Office at the U.S. Department of Energy.