| Disclaimer: This webpage provides an overview of how the DOE Efficient New Homes program relates to the New Energy Efficient Home Credit found in Section 45L of the Internal Revenue Code (45L tax credit). The information provided here does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making decisions regarding design, purchasing, investments, the tax implications of new home construction or substantial reconstruction, or when executing other binding agreements. Individuals or entities looking to claim the credit should consult with a tax professional to determine whether and how they can claim the credit and determine whether the credit can be used with other tax incentives or Federal incentives. If there is a conflict between information provided on this webpage and guidance released by the Internal Revenue Service (IRS), the guidance released by the IRS shall take precedence. |

| The One Big Beautiful Bill Act (P.L. 119-21), enacted on July 4, 2025, revised dates and provisions in the Internal Revenue Code that affect some or all of the tax credits described below. Though these pages should not be considered tax advice, they are subject to change as more information becomes available. For additional information, please see Treasury.gov or IRS.gov. |

Amended Section 45L

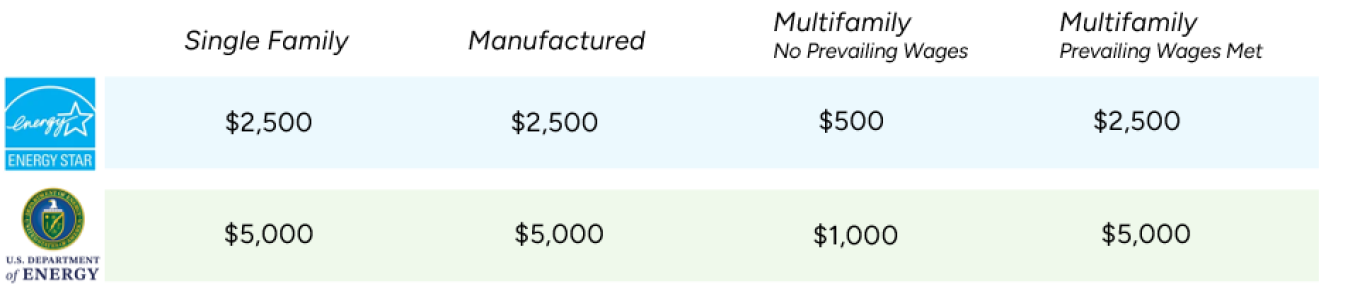

The Inflation Reduction Act of 2022 (IRA) amended Internal Revenue Code Section 45L to provide eligible contractors with a business tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Efficient New Homes program requirements. See below for available amounts. The amended 45L tax credit applies to qualified new energy efficient homes acquired after December 31, 2022, and before July 1, 2026 (per the One Big Beautiful Bill Act of 2025). Eligible contractors may claim the credit for the taxable year in which the home or dwelling unit was acquired for use as a residence.

Amounts Available Under Section 45L for Certified ENERGY STAR and DOE Efficient New Homes

Successor Program

The DOE Zero Energy Ready Home program is now known as DOE Efficient New Homes. DOE Efficient New Homes is the successor program to DOE Zero Energy Ready Home. Materials across DOE's websites have been updated accordingly to account for the successor program. The DOE ZERH program and the DOE Efficient New Homes program remain substantively the same.

DOE Efficient New Homes and the 45L Tax Credit

For certified DOE Efficient New Homes acquired after December 31, 2022, Section 45L and IRS Notice 2023-65 set forth specific eligibility requirements for the 45L tax credit, which include:

-

Be eligible to participate in the ENERGY STAR Residential New Construction program.

Select the program version that corresponds with the housing type:

-

Earn certification under the DOE Efficient New Homes program.

Use the requirements indicated on the DOE Efficient New Homes Program Requirements webpage.

-

Be acquired (including sale or lease) by a person from an eligible contractor.

The eligible contractor may claim the 45L credit for the taxable year in which the home or dwelling unit was acquired for use as a residence.

The DOE Efficient New Homes program version that is in effect for a given project is based on the type of housing (single family, multifamily, manufactured) and the Permit Date for the project (or Production Date in the case of Manufactured Homes) as stipulated in the applicable DOE Efficient New Homes program requirements document. The DOE Efficient New Homes Program Requirements webpage establishes the certification requirements in effect for each program version by Permit or Production Date, as applicable. Program version effective dates are listed in the table on the webpage, and these dates govern the DOE Efficient New Homes program in effect for the purpose of Section 45L. Program requirements documents include detailed definitions of eligible building types.

Frequently Asked Questions

Answer: Section 45L does not provide that a dwelling unit must be certified to the lower-tier energy saving requirements (i.e., ENERGY STAR certification) to be eligible for the higher-tier credit (which requires certification under the DOE Efficient New Homes program).

Under section 4.04(1) of IRS Notice 2023-65, a dwelling unit meets the energy saving requirements for the higher-tier credit if the unit is certified under the DOE ZERH program (or any successor program, including DOE Efficient New Homes). Section 6.03 of the notice provides that certification requirements for the effective DOE ZERH program (or any successor program, including DOE Efficient New Homes) are provided on the DOE ZERH web page (or successor web page). Therefore, for a dwelling unit to be eligible for the higher-tier credit, it must be certified under the applicable DOE ZERH (or DOE Efficient New Homes) program version (based on building type, permit date, and project location), regardless of the energy saving requirements which would apply to the dwelling unit to be eligible for the lower-tier credit.

Answer: The dwelling unit must be certified. Section 45L(c)(1)(B), as amended by the IRA, provides that a dwelling unit meets the energy saving requirements for the 45L tax credit if it is “certified as a zero energy ready home under the zero energy ready home program of the Department of Energy as in effect on January 1, 2023 (or any successor program determined by the Secretary).” Section 4.04(1) of IRS Notice 2023-65 also provides that “[a] dwelling unit meets the energy saving requirements under §45L(c)(1)(B) if such dwelling unit is certified as a zero energy ready home under the ZERH program established by the DOE…”

Newer program versions and revisions to program versions may optionally be used earlier than the required date once they are issued by DOE. A project certified under a newer program version or revision is also deemed to meet the certification requirements of corresponding earlier (older) versions or revisions. Projects must meet all building eligibility requirements (type and location) as stated in the program documents applicable to the version and revision used for certification.

Answer: Section 45L(a)(1) provides that an “eligible contractor” may claim the 45L tax credit. An eligible contractor is the person that constructed the qualified home, owned and had a basis in the qualified home during its construction, and sold or leased the home to a person for use as a residence. In the case of a qualified home that is a manufactured home, an eligible contractor is the person that produced such home and owned and had a basis in such home during its production. For example, if a person that owns and has a basis in a qualified home during its construction hires a third-party contractor to construct the home, the person that hires the third-party contractor is the eligible contractor and the third-party contractor is not an eligible contractor. However, a home is not considered to have been acquired if the eligible contractor retains it for use as a residence. See Sections 5.01 and 5.02 of IRS Notice 2023-65.

For more information, please see the IRS website.

Answer: For qualified homes acquired on or before December 31, 2022, the minimum requirements for certifiers remain the same as in prior years when the 45L tax credit has been in effect. Additional information may be found in IRS Notices 2008-35 and 2008-36.

For qualified homes acquired after December 31, 2022, the requirements for certifiers are based on the quality assurance systems in place for the ENERGY STAR and DOE Efficient New Homes programs. Both programs have established requirements for the certifiers of dwelling units which must be followed. These requirements are referenced in the ENERGY STAR and DOE Efficient New Homes program requirements documents. (Source: IRS Notice 2023-65, Section 6.)

Answer: Section 45L(g)(2)(A) provides that “the taxpayer shall ensure that any laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the construction of [the qualifying] residence shall be paid wages at rates not less than the prevailing rates for construction, alteration, or repair of a similar character in the locality in which such residence is located as most recently determined by the Secretary of Labor...”

Additional information including notices and FAQs is available on the IRS prevailing wage and apprenticeship requirements site.

Answer: In cooperation with the IRS, the DOE has maintained a system for software requirements, review, and approval of software for use in section 45L certifications. DOE has updated this software list to reflect the extension of the 45L tax credit under the IRA for qualified homes acquired on or before December 31, 2022. The guidance is posted on the DOE website.

For qualified homes acquired after December 31, 2022, IRS Notice 2023-65 provides that rules for the software to be used for purposes of providing a certification are under the respective ENERGY STAR and DOE program requirements. DOE will recognize the software approval processes already in place for the ENERGY STAR Residential New Construction program and the DOE Efficient New Homes program. Further guidance is posted on the DOE website.

For details on claiming the 45L tax credit, including information about completing Form 8908 (Energy Efficient Home Credit), visit the IRS website. Eligible contractors are encouraged to practice good recordkeeping of all documents required to support a claim for the 45L tax credit, including proof of ZERH certification for each qualified new energy efficient home being claimed. See Section 7 of IRS Notice 2023-65.

Yes. Claiming the 45L tax credit is not required to participate in the DOE Efficient New Homes program.

Homes and apartments in California are able to participate in the DOE Efficient New Homes program using the current version of the DOE Efficient New Homes California program requirements. Partners should closely review the Program Version Effective Dates table (see DOE Efficient New Homes Program Requirements website). As with homes in other jurisdictions, homes certified under the DOE Efficient New Homes California program requirements may claim the 45L tax credit if all applicable requirements are met.