Learn about the role of the Loan Programs Office at the Department of Energy

Office of Energy Dominance Financing

August 11, 2022There are many energy technologies that are mature from a technology standpoint but need access to capital to deploy at scale — that’s a nexus where there’s a clear mandate for DOE’s Loan Programs Office (LPO) to participate.

While significant capital is available for clean energy and advanced transportation technologies, these projects can still lack access to adequate debt capital. LPO fills this gap in commercial deployment by serving as a “bridge to bankability” for innovative, large-scale, high-impact energy technologies, providing them with access to needed loans and loan guarantees when private lenders cannot or will not until a given technology has reached full market acceptance. Currently, LPO has billions in available loan authority through four financing programs:

- Title 17 Clean Energy Financing,

- Advanced Transportation Financing (via the ATVM loan program),

- Tribal Energy Financing (via the TELGP loan program), and

- Carbon Dioxide Transportation Infrastructure Financing (via the CIFIA loan program).

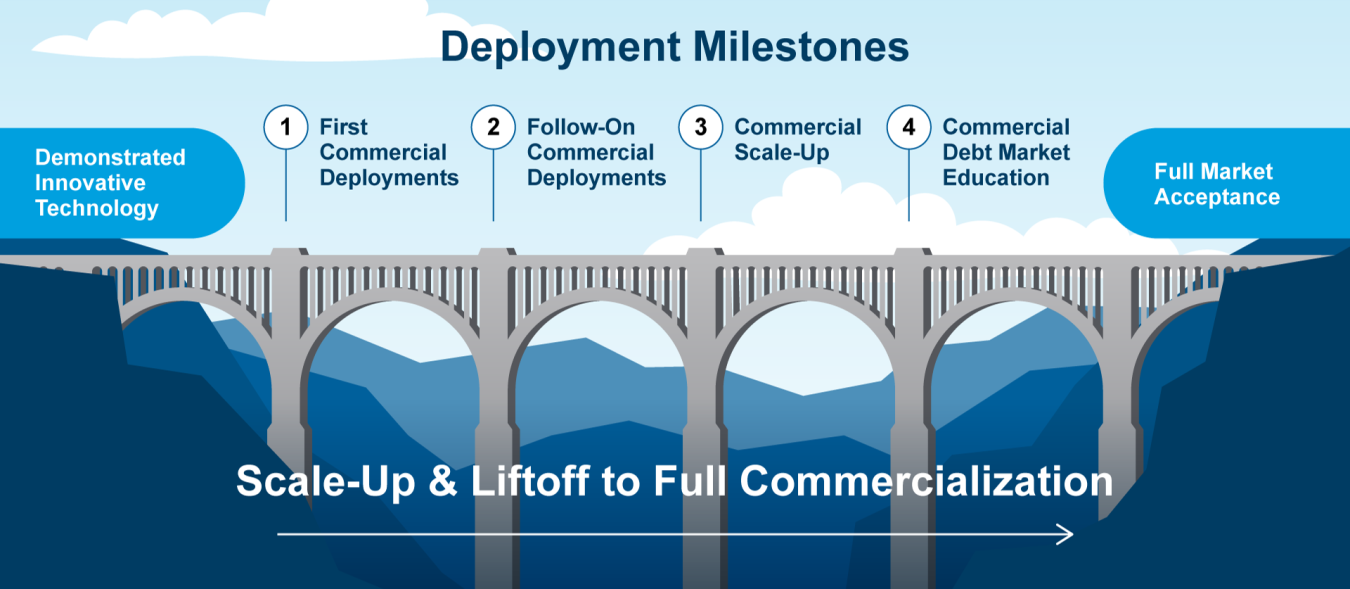

LPO provides a bridge to bankability for those technologies to cross the final milestones to commercialization:

- The first commercial-scale deployment, to address the engineering scale-up challenges and demonstrate technology effectiveness at scale;

- The next few commercial-scale deployments, to demonstrate the ability to mitigate construction risks and address engineering optimization;

- Commercial scale-up, to progress along the learning curve, lower costs, and establish customer demand;

- Commercial debt market education, to overcome private debt market misunderstanding and gain commercial debt access.

The starting point of LPO’s committed partnership with its borrowers is through the office’s Outreach and Business Development Division, which brings together an internal team of energy experts with deep experience across the financial, technical, legal, risk, and environmental fields to help borrowers move through pre-application consultations and the application process, and through the due diligence and underwriting process led by LPO’s Origination Division.

After loan closing, LPO’s Portfolio Management Division, in coordination with the Technical and Project Management Division, maintains this borrower partnership through construction, project operation and maintenance, and eventual final loan repayment. This approach is essential to achieving project milestones and overall project success while protecting taxpayer interests and has been successful: of the $32.70 billion that has been disbursed to date, $14.07 billion in principal has been repaid, along with $4.49 billion in interest, which exceeds losses by more than $3 billion.

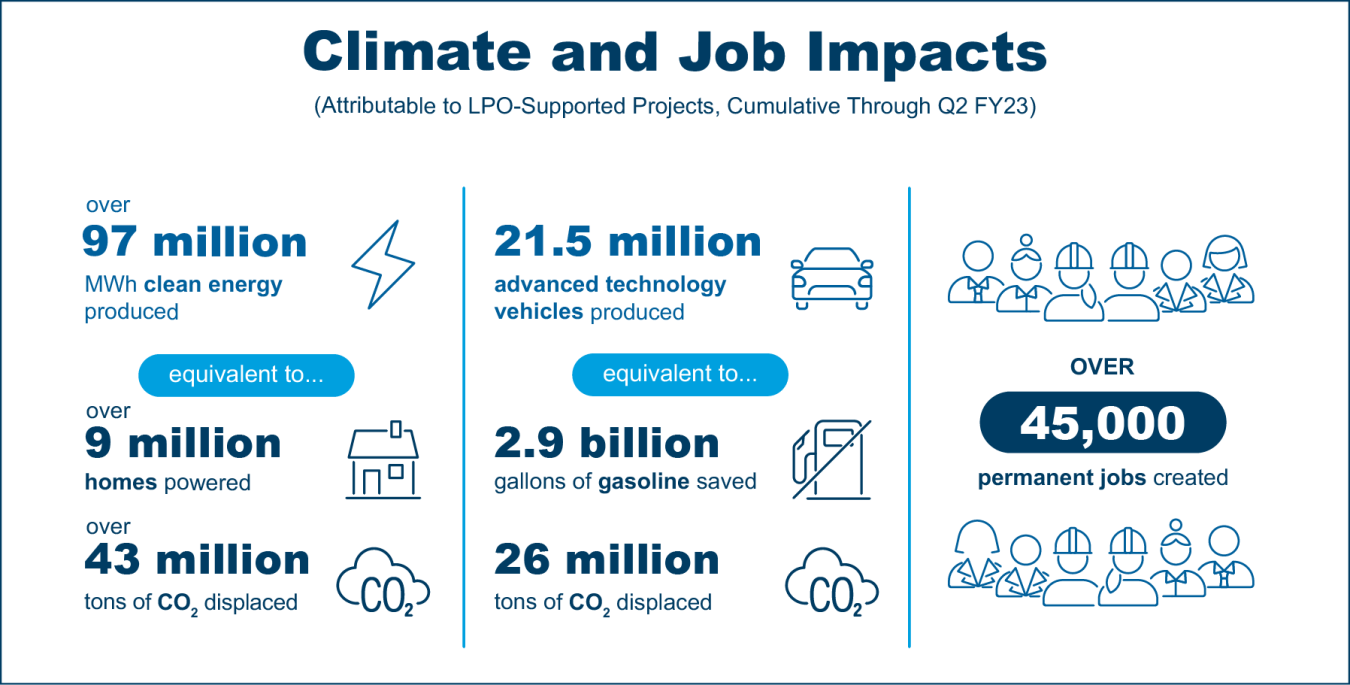

In addition to strong financial performance, LPO projects are making an impact. In total, these projects have created over 45,000 permanent jobs. And throughout its history, LPO energy projects have generated nearly 94 million MWh of electricity cumulatively, including roughly 9.5 million MWh generated in FY 2022. LPO’s innovative technology projects have also contributed to the avoidance of almost 43 million tonnes of CO2 cumulatively, including roughly 4 million tonnes in FY 2022

Meanwhile, ATVM-supported projects have cumulatively displaced 19.2 billion gallons of gasoline, or the equivalent of 26 million tonnes of CO2. More specifically, through the use of LPO-funded automobiles, the equivalent of roughly 250 million gallons of gasoline is saved per year compared to traditional vehicles. LPO automotive manufacturing projects have also produced roughly 22 million fuel-efficient vehicles and their components cumulatively.

With a robust pipeline of active applications representing billions in requested project financing in the form of loans and loan guarantees across a variety of sectors, LPO is poised to continue building on that success and contribute to driving capital formation to deploy the clean energy and advanced transportation technologies needed to reach our national goals.