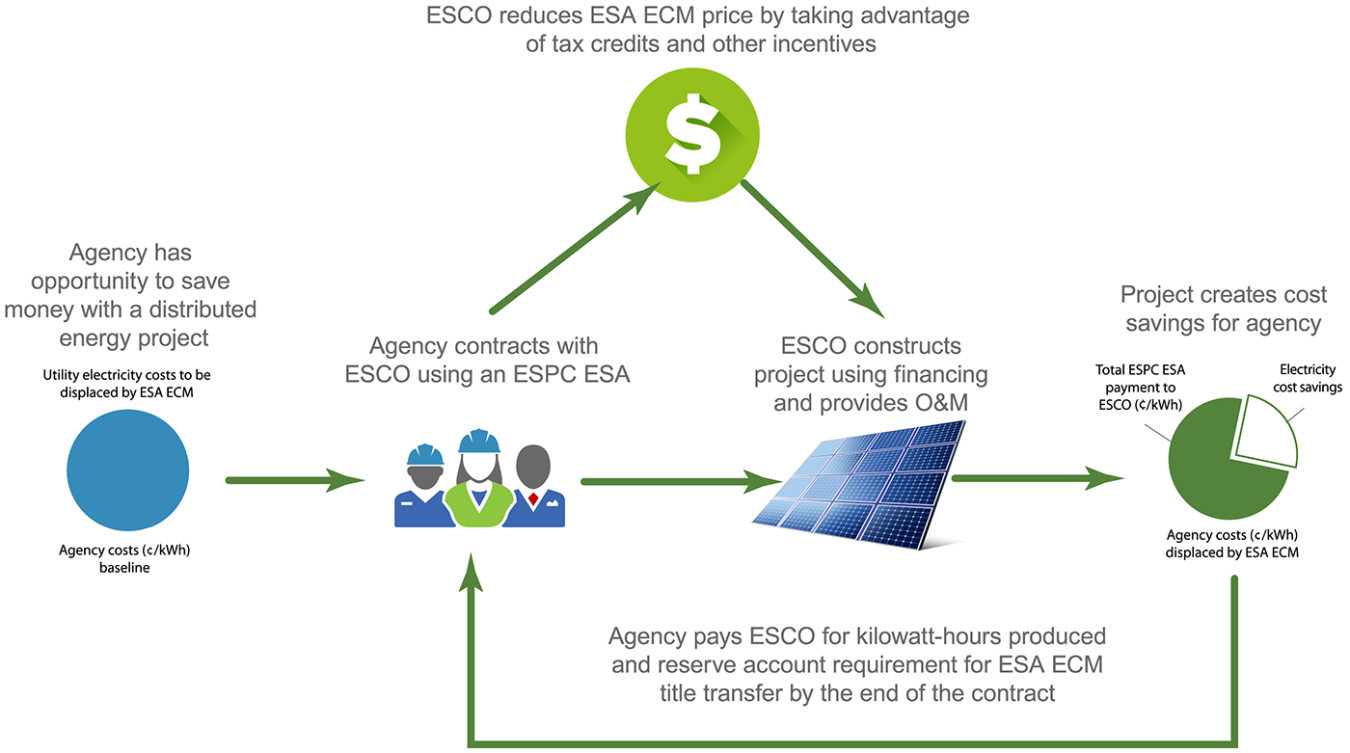

An energy savings performance contract energy sales agreement (ESPC ESA) is a project structure, similar to a power purchase agreement, that uses the multiyear ESPC authority to implement distributed energy projects—referred to as ESA energy conservation measures (ECMs)—on federal buildings or land. The ESA ECM is initially privately owned for tax incentive purposes, and the federal agency purchases the electricity it produces with guaranteed cost savings. An ESPC can be used for the acquisition of utility services per 48 CFR § 41.102(b)(7) (2015).

Video courtesy of the U.S. Department of Energy

Start an ESPC ESA

To start an ESPC ESA, an agency should review the ESPC ESA requirements and contract vehicle options. For questions, more information, or assistance:

- Contact a federal project executive

- Request assistance from the Federal Energy Management Program (FEMP) through the Technical Assistance for Distributed Energy Projects portal

- Request a screening for distributed energy opportunities including optimization.

ESPC ESA Resources

On-Site Project Contract Options

Below is a comparison table to help you determine the best contract option for your planned onsite project.

| CONTRACT VEHICLE | On-Site electricity Purchase contract | ESPC ESA |

|---|---|---|

| Authority and maximum contract term |

| 42 U.S.C. § 8287 – 25 years (limited to 20 years for ESA- IRS Rev. Proc. 2017-19) |

| ECM types | Limited to on-site generation/storage | Can include other ECMs as part of a comprehensive project |

| Title retention at end of term | Title retention optional | Title retention required by end of term (OMB Memo M-12-21) |

| Cost savings | Not statutorily required | Statutory annual cost savings requirement |

Benefits of ESPC ESAs

- ESPC ESAs do not require any upfront capital from a federal agency for the ESA ECM.

- ESPC ESAs provide guaranteed cost savings, and a federal agency only pays for the electricity that is generated, minimizing federal risk.

- The energy service company (ESCO) may be able to take advantage of federal and other tax incentives and can sell the renewable energy certificates generated by the ESA ECM to reduce the ESPC ESA price.

- The ESCO is responsible for ESA ECM operations and maintenance, and for equipment repair and replacement, which also reduces federal risk.

The ESPC ESA project structure

ESPC ESA Requirements

ESPC Authority Requirements: The ESPC ESA must meet all ESPC legal requirements (see 42 U.S.C. § 8287, et seq.), including the requirement that the agency pay for the cost of the ESPC ESA from the energy cost savings generated each year over the life of the contract. The ESCO must be on the U.S. Department of Energy's (DOE) Qualified List of ESCOs or an agency’s list of qualified contractors prior to contract award.

Office of Management and Budget (OMB) Requirements: In order for ESPC (including ESPC ESA) contracts to be scored annually, they must be consistent with OMB Memo M-12-21, "Addendum to OMB Memorandum M-98-13 on Federal Use of Energy Savings Performance Contracts (ESPCs) and Utility Energy Service Contracts (UESCs)." ESPC ESA contracts must be consistent with the requirement that the federal government retain title to on-site energy generation by the end of the contract.

Tax Incentive Requirements: The ESCO may be eligible for tax incentives such as the federal Investment Tax Credit and the Modified Accelerated Cost Recovery System. The Internal Revenue Service Revenue Procedure 2017-19, published in Internal Revenue Bulletin 2017-7, provides a safe harbor under which the IRS will not challenge the treatment of an ESPC ESA as a service contract under 26 U.S.C. § 7701(e)(3). Section 4 specifies safe harbor requirements, including a maximum contract length of 20 years. Section 5 contains details regarding an example ESPC ESA project. Tax incentive eligibility due diligence is the responsibility of the ESCO, not the government.

Learn How ESPC ESAs Work

Learn How ESPC ESAs Work: An ESPC ESA is a great way to develop on-site distributed energy, get operations and maintenance services for the term of the agreement, and take advantage of other energy and cost-savings benefits.

ESPC ESA Successes

The National Institute of Standards and Technology (NIST) installed a 5 MW-DC photovoltaic (PV) system under an ESPC ESA. The system is projected to save NIST $3.5 million (nominal dollars) over the 20-year contract term. Read the ESPC ESA Case Study: Energy Affordability at the National Institute of Standards and Technology.

The U.S. Drug Enforcement Administration (DEA) installed a 2.5 MW-DC PV system under an ESPC ESA. DEA selected a private ownership scenario, which will save the agency more than $1 million (nominal dollars) over 20 years compared with the government ownership option. Read the ESPC ESA Case Study: Energy Affordability at the Drug Enforcement Administration.