The Loan Programs Office (LPO) publishes the LPO Monthly Application Activity Report – a new way to understand the level of interest from applicants for LPO financing, and what technology sectors have been most actively engaged with LPO.

Office of Energy Dominance Financing

November 9, 2023Hi-res graphics for download: MAAR Metrics-Tech Sector Breakdown, MAAR Proposed Project Locations, and MAAR Remaining Program Authority

Each month, the LPO Monthly Application Activity report updates:

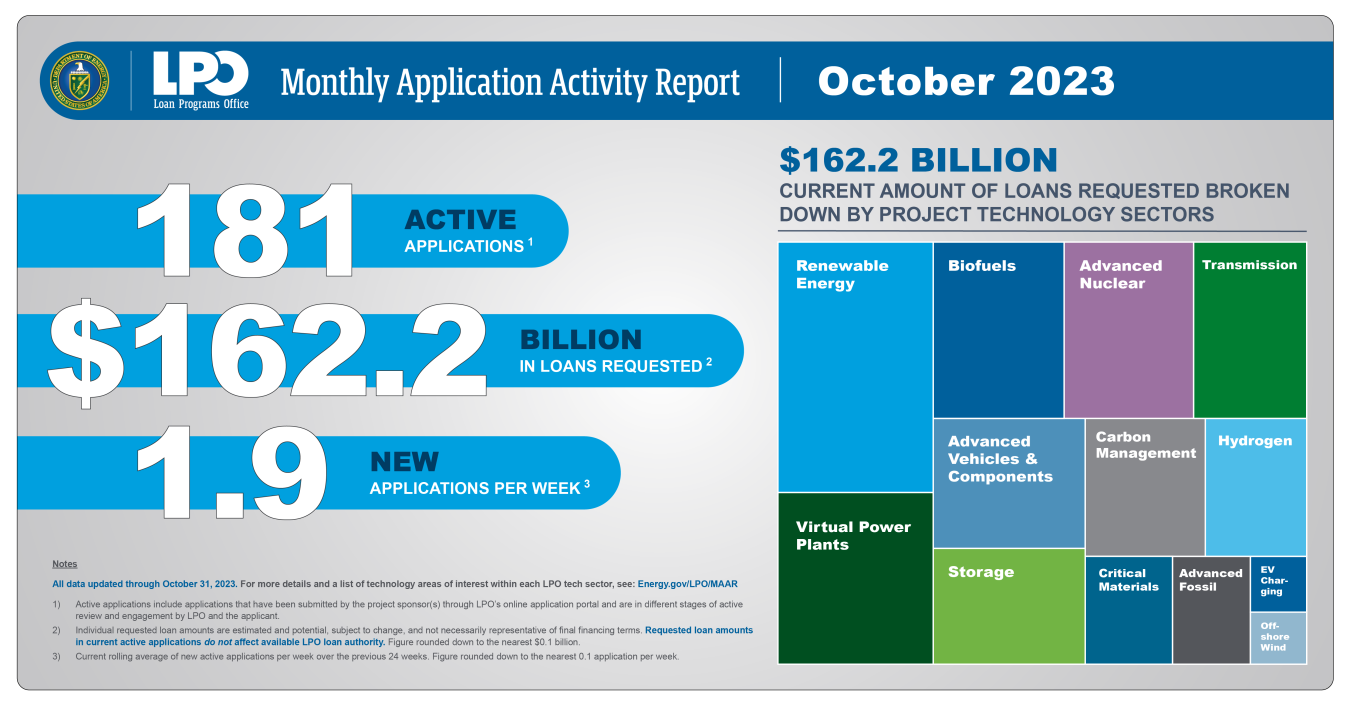

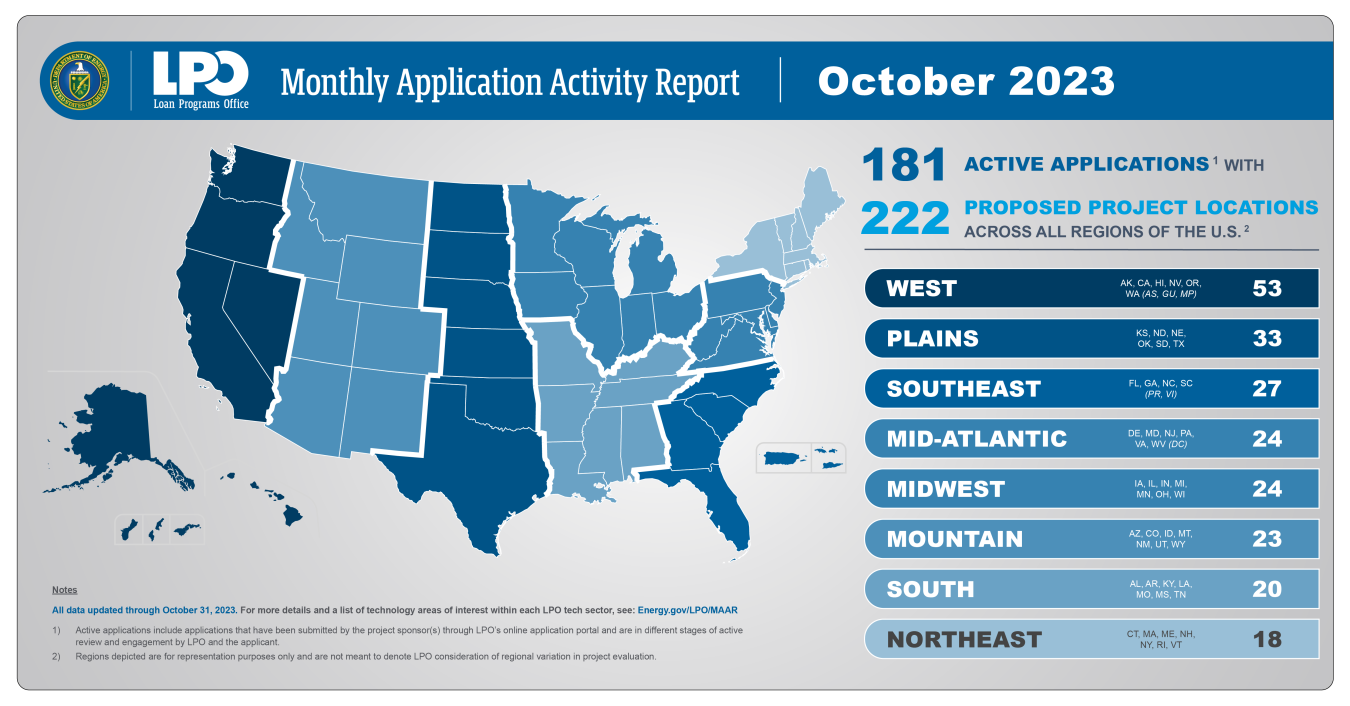

- The total number of current active applications that have been formally submitted to LPO (181 as of October 31, 2023 vs 177 as of September 30, 2023)

- The cumulative dollar amount of LPO financing requested in these active applications ($162.2 as of October 31, 2023 vs $157.1 billion as of September 30, 2023)

- The 24-week rolling average of new applications per week as of the close of the previous month (1.9 as of October 31, 2023 vs 2.1 as of September 30, 2023)

- Technology sectors represented by applications

- Proposed project locations represented by applications

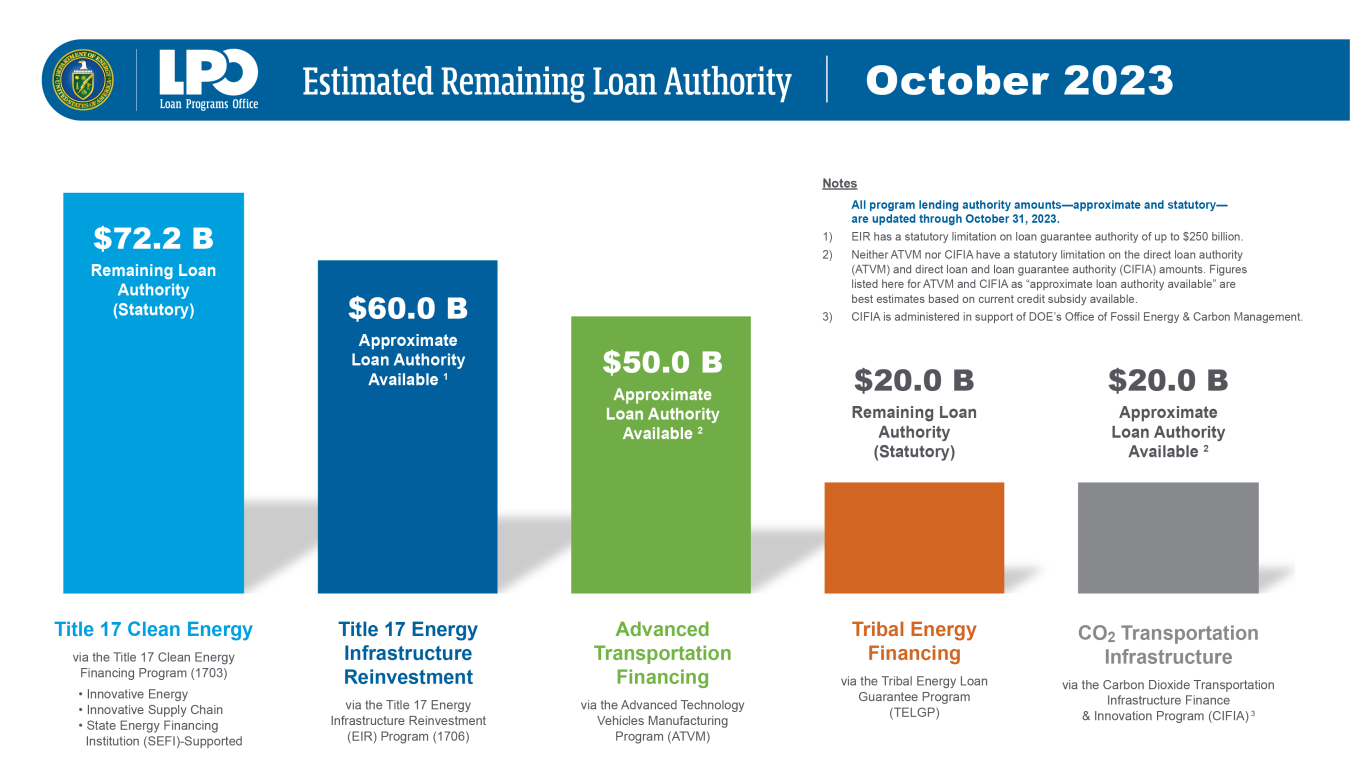

The report breaks down the cumulative loan amount requested of current applications into general technology sectors that are potentially eligible under the Title 17 Clean Energy Financing Program (Title 17, Sections 1703 and 1706), Advanced Technology Vehicles Manufacturing (ATVM) Loan Program, Tribal Energy Financing Program, or Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) Program:

- Advanced Fossil (Carbon Feedstock Waste Conversion, Fossil Infrastructure Repurposing & Reinvestment, Hybrid Generation, Hydrogen Generated From Fossil Sources, Industrial Decarbonization, Synfuel)

- Advanced Nuclear (Advanced Nuclear Reactors, Micro Reactors, Nuclear Fuel Cycle, Nuclear Supply Chain, Nuclear Uprates & Upgrades, Small Modular Reactors (SMRs))

- Advanced Vehicles & Components (Vehicles, Components, Lightweighting, Manufacturing, Electric Vehicle (EV) Battery Manufacturing)

- Biofuels (Advanced Biofuels, Biodiesel, Cellulosic Biofuels, Renewable Diesel, Renewable Natural Gas (RNG), Sustainable Aviation Fuel (SAF))

- Carbon Management (Carbon Capture & Storage (CCS), Carbon Dioxide Removal (CDR), Direct Air Capture (DAC), Industrial Decarbonization, CO2 Transportation Infrastructure)

- Critical Materials (Extraction, Manufacturing, Mining, Processing, Recovery, Recycling)

- EV Charging (Deployment, Manufacturing)

- Hydrogen (Generation, Infrastructure, Transportation)

- Offshore Wind (Offshore Wind Generation, Offshore Wind Supply Chain & Vessels)

- Renewable Energy (Electrification, Geothermal, Hydrokinetics, Hydropower, Repowering Onshore Wind, Solar Supply Chain, Waste Conversion)

- Storage (EV Bidirectional Storage, Newer Battery Chemistries & Flow Batteries, Compressed Air Energy Storage, Pumped Storage Hydropower, Thermal Energy Storage)

- Transmission (Grid Efficiency, Grid Reliability, High-Voltage Direct Current (HVDC) Systems, Offshore Wind Transmission, Systems Sited Along Rail & Highway Routes)

- Virtual Power Plants (Connected Distributed Energy Resources (DERs))

(These sectors are not an exhaustive list of technologies that may be eligible for LPO’s loan programs.)

Submission of an application or approval of an application for purposes of continuing due diligence, underwriting, and negotiations is not an assurance that DOE will offer a Conditional Commitment, a loan, or a loan guarantee. Potential borrowers are encouraged to engage with LPO staff in pre-application consultations to learn more about LPO’s programs and processes. Learn more about working with LPO: energy.gov/LPO/about-us and more about the LPO application process: energy.gov/lpo/application-process.