A study from LBNL finds that the market value of offshore wind generally exceeds that of land-based wind in the region.

Wind Energy Technologies Office

October 12, 2018DOE-funded study combines historical weather data and wholesale market outcomes

A study from Lawrence Berkeley National Laboratory (LBNL) finds that the market value of offshore wind—considering energy, capacity, and renewable energy certificate (REC) value—varies significantly along the U.S. East Coast and generally exceeds that of land-based wind in the region. The study's focus on the value of offshore wind complements the large body of existing work that has analyzed the cost of offshore wind.

A single 30-megawatt (MW) project operating off the coast of Rhode Island has driven interest in offshore wind development in recent years, particularly along the East Coast where there is a perception that offshore wind may provide greater value than some other forms of electricity generation. However, the economic value of wind power can vary significantly by location, depending on the time-varying wind resource profile at a given site, as well as local pricing and market rules within the regional power market. Specifically, differences in these variables can affect the local price of electricity and RECs that wind power earns, as well as wind's contribution to meeting peak demand.

The new study, funded by the DOE, unpacks these value components by exploring a hypothetical question: What would the marginal economic value of offshore wind projects along the East Coast have been from 2007 to 2016, had any such projects been operating during that time?

LBNL researchers answered this question by developing a rigorous approach based on historical weather data at thousands of potential offshore wind sites combined with historical wholesale market outcomes and REC prices. Specific value components that were examined both geographically and over time included energy, capacity, and REC value, avoided air pollution, and reductions in wholesale power and natural gas prices via the merit-order effect.

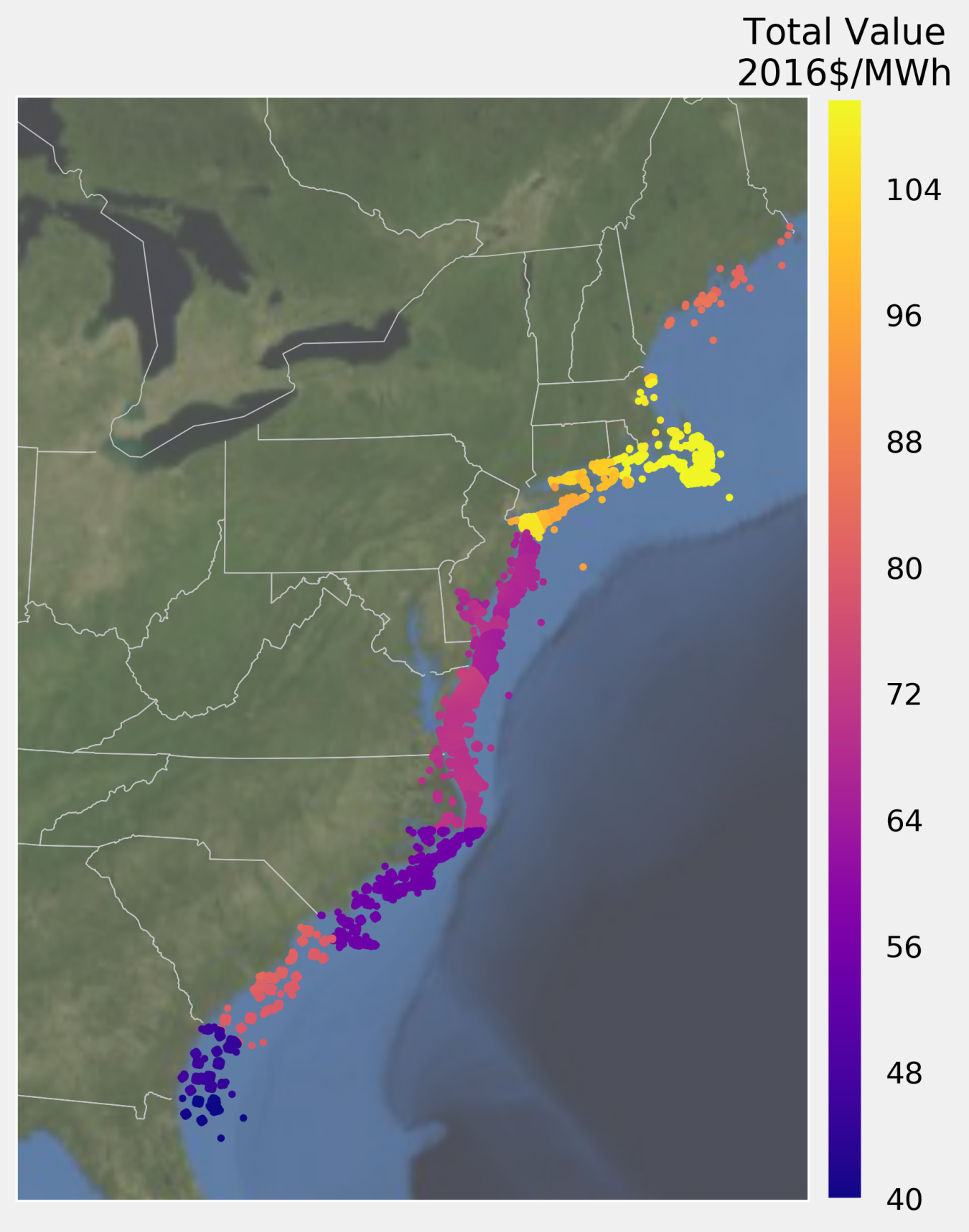

The research found that the historical market value of offshore wind—considering only energy, capacity, and REC value—varied significantly by project location. The average market value from 2007 through 2016 was highest for sites off the coasts of New York, Connecticut, Rhode Island, and Massachusetts—i.e., all areas where offshore wind is actively pursued—and lowest for sites along the southeastern coast (see graphic). The analysis also found that offshore wind can reduce air pollution and wholesale electricity and natural gas prices, though effects varied in magnitude over time and across regions.

The new study, funded by DOE, unpacks the value components of offshore wind by exploring a hypothetical question: What would the marginal economic value of offshore wind projects along the East Coast have been from 2007 to 2016, had any such projects been operating during that time?

Total market value (energy + capacity + REC at each site, averaged over 2007–2016).

Impact

"This research can provide important insights to a variety of stakeholders… about where offshore wind projects are likely to provide the most value, or at least about what are likely to be the primary drivers of relative value."

Andrew Mills, Lawrence Berkeley National Laboratory

The historical market value of offshore wind was also found to have exceeded that of land-based wind because offshore wind sites are closer to major population centers and have time-varying profiles of electricity production that are more correlated with electricity demand. Yet, the cost of offshore wind is also higher than that of land-based wind, requiring important economic trade-offs. Cost reductions that approximate those witnessed recently in Europe may be needed for U.S. offshore wind to offer a credible long-term economic value proposition on a widespread basis along the Eastern Seaboard.

Finally, the research discusses how the various value components might change in the future and assesses multiple ways to potentially enhance the value of offshore wind, including by varying the location of grid interconnection and adding electrical storage.

These findings come with several caveats. For example, while the historical perspective taken in this study is instructive in terms of identifying key value drivers for offshore wind, the decision to build offshore wind going forward will depend on expectations of future benefits, which may differ from recent historical experience.

"Despite the caveats, this research can provide important insights to a variety of stakeholders—including offshore wind developers and purchasers, as well as energy system decision-makers—about where offshore wind projects are likely to provide the most value, or at least about what are likely to be the primary drivers of relative value," explains Andrew Mills, the study's lead author. "In addition, focusing on market value may help to inform the U.S. Department of Energy on its offshore wind technology cost targets, as well as the early-stage R&D investments necessary to reach them."

A 12-page executive summary, accompanied by a more-detailed slide deck that explains the study and a journal article submission, can be downloaded at https://emp.lbl.gov/publications/estimating-value-offshore-wind-along.