The cost of crude oil is nearly half of the price of a gallon of gasoline, and the cost of refining is another 16%.

July 24, 2017SUBSCRIBE to the Fact of the Week

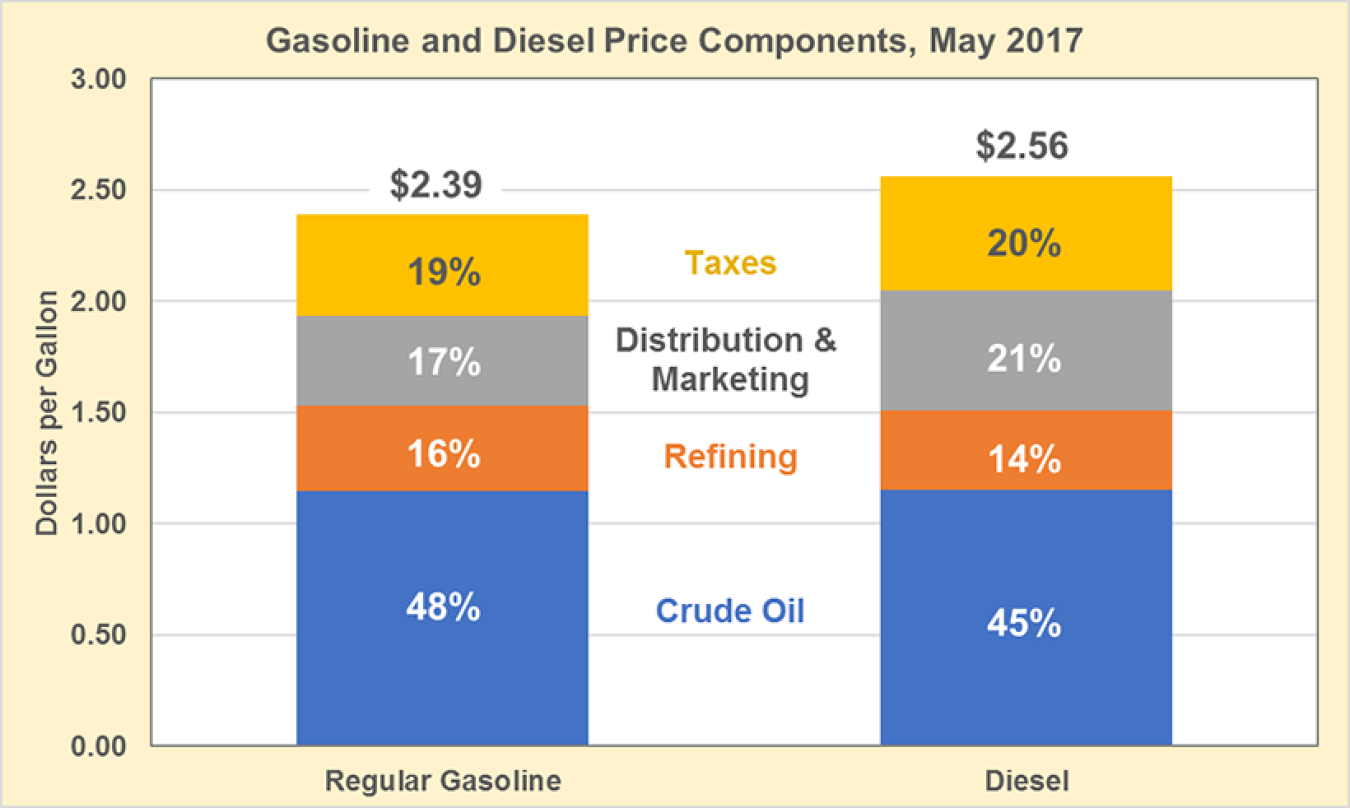

The cost of crude oil is nearly half of the price of a gallon of gasoline, and the cost of refining is another 16%. Distribution and marketing of the fuel and taxes assessed by federal and state governments account for the remainder of the price. The components of the price of diesel fuel are similar to gasoline, with a slightly higher share of cost for taxes, distribution and marketing. Gasoline taxes vary across the nation, with state taxes ranging from 9 cents to 58 cents per gallon and a constant federal tax of 18.4 cents per gallon. Diesel taxes are higher, ranging from 9 cents to 74 cents per gallon and a constant federal tax of 22.4 cents per gallon.

Gasoline and Diesel Price Components, May 2017

Note: Regular gasoline is defined as having an antiknock index, i.e., octane rating, greater than or equal to 85 and less than 88. Most regular gasoline contains ethanol, the cost of which is not explicitly stated in the price components. Implicitly, the cost of ethanol is included in the Distribution and Marketing category. See the full methodology for details.

Source: Data: Energy Information Administration, Gasoline and Diesel Fuel Update, accessed June 27, 2017.

Tax references in text: Federation of Tax Administrators from various sources, State Motor Fuel Tax Rates, January 1, 2017, accessed June 27, 2017.