The report "Federal Support Opportunities to Remediate and Redevelop Energy Assets" outlines how federal resources can be utilized to revitalize economies in energy communities across America.

Office of Energy Dominance Financing

June 29, 2023With a strategic set of current federal policy incentives, it’s a great time to invest in American clean energy and address legacy pollution in local communities. With the passage of President Biden's Inflation Reduction Act (IRA), communities, site owners, and developers can access never-before-available loan guarantees to redevelop and repurpose legacy energy assets in energy communities. In collaboration with the U.S. Department of Energy’s (DOE) Office of Policy and the Loan Programs Office, the Pacific Northwest National Laboratory (PNNL) published a report titled “Federal Support Opportunities to Remediate and Redevelop Energy Assets,” which outlines how federal resources can be utilized to revitalize economies in energy communities across America.

Driving Clean Energy Investment in America’s Energy Communities

Energy communities, particularly those that have been home to coal, oil, natural gas, and power plant activities, drove the industrial revolution and are essential to the prosperity of the United States. Today, energy communities, their families, and surrounding communities face a different challenge — coal mine and coal power plants that have closed, declines in coal production and generation, and long-term environmental and health effects from fossil energy generation.

The Biden-Harris Administration has been able to utilize the historic funding made available through the President's Investing in America Agenda — Bipartisan Infrastructure Law, CHIPS and Science Act and IRA — to spur reinvestment in our energy communities, striving to ensure that no one is left behind as the nation evolves to produce clean energy, manufacture new energy products, and create robust American-made supply chains across the United States. More than $500 billion of broadly available federal funding opportunities and 22 tax credits have been identified to meet the needs and interests of energy communities.

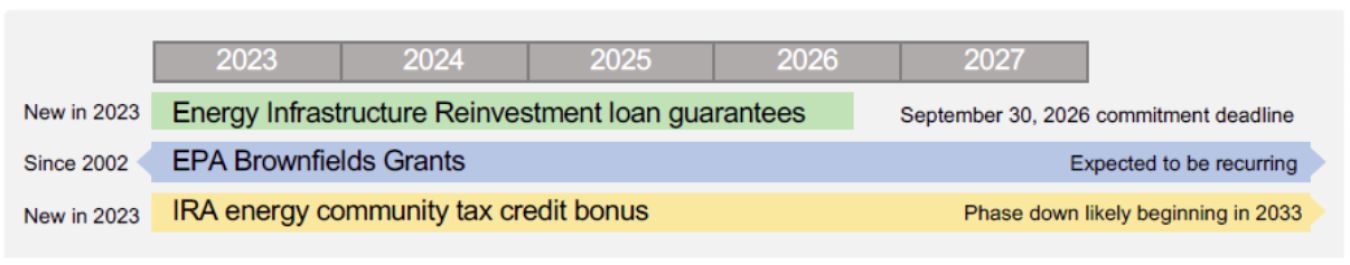

The PNNL report provides an overview of how the newly created DOE Loan Programs Office (LPO) Energy Infrastructure Reinvestment (EIR) loan guarantees, longstanding Brownfields Grants from the Environmental Protection Agency (EPA), and tax credits from the IRA can be used independently or together to help redevelop or repurpose energy infrastructure to revitalize American communities.

DOE recognizes that environmental degradation resulting from abandoned fossil energy infrastructure is an environmental justice issue and an impediment to economic revitalization. Communities, site owners, and developers can work together to combine energy incentives with contaminated land cleanup incentives to create economically viable clean energy redevelopment projects on brownfields.

Financing Opportunities with the EIR Program

In May 2023, LPO announced Program Guidance for its Title 17 Clean Energy Financing Program, including eligibility under the EIR (Section 1706) category of Title 17. Under EIR, LPO can finance projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations. Additionally, LPO can finance projects that upgrade operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or greenhouse gas emissions. For more information about EIR and Title 17 program requirements, review the full Program Guidance here.

Interested parties are invited to request a no-cost pre-application consultation with LPO. To facilitate a productive consultation, all potential applicants are encouraged to include information summarizing the project goals, technology, financing needs, and timing. During the consultation, LPO will work with potential applicants to determine whether the project may be eligible for financing.

Cleaning Up Communities Through Brownfields Grants

Grants to revitalize brownfield sites are available through EPA’s Brownfields and Land Revitalization Program. EPA Brownfields Grants can take several forms, including grants for site assessment, cleanup, multipurpose, revolving loan funds, and job training. Eligible entities can apply directly for Brownfields Grants funding via the annual brownfields grant competition. More information on brownfields site eligibility criteria can be found here.

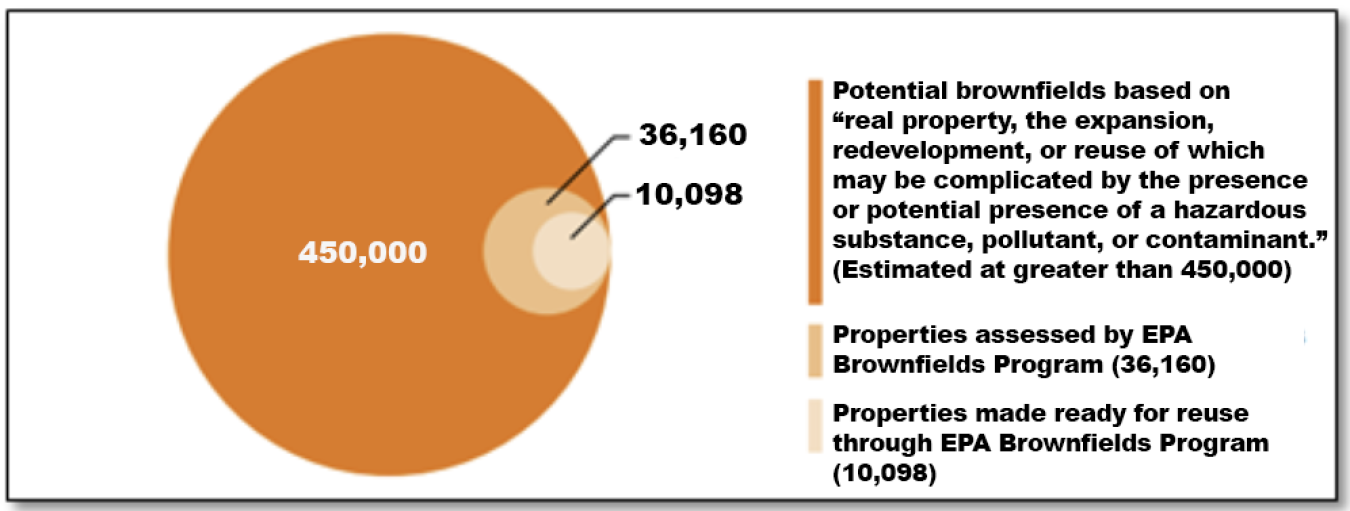

It is estimated that there are more than 450,000 brownfield sites in the United States. Cumulatively, EPA’s program has assessed more than 36,000 brownfield sites and made more than 10,000 of these sites ready for reuse through assessment and cleanup. EPA’s Cleanups in My Community shows sites supported using EPA Brownfields funding. LPO’s new EIR loan authority now provides an additional tool that can help finance brownfields cleanup. For a project to be eligible for an EIR financing, it will need to qualify along other LPO qualification criteria as described in Title 17 Program Guidance, including requirements for energy-related end use of the site after remediation and an assessment of prospect of loan repayment.

Incentivizing Clean Energy Projects with Clean Energy Tax Credits

The IRA also created clean energy production and investment tax credits (PTC and ITC) to spur clean energy development. The ITC and PTC can cover up to 30% of the investment cost of a project when prevailing wage and apprenticeship requirements are met. In addition to the 30% “base” tax credit, several bonus credits are also available. These bonuses include a 10% domestic content bonus, 10-20% low-income communities bonus and a 10% energy communities bonus. These bonuses can be combined, meaning the total qualifying investment tax credit could theoretically be as high as 70%.

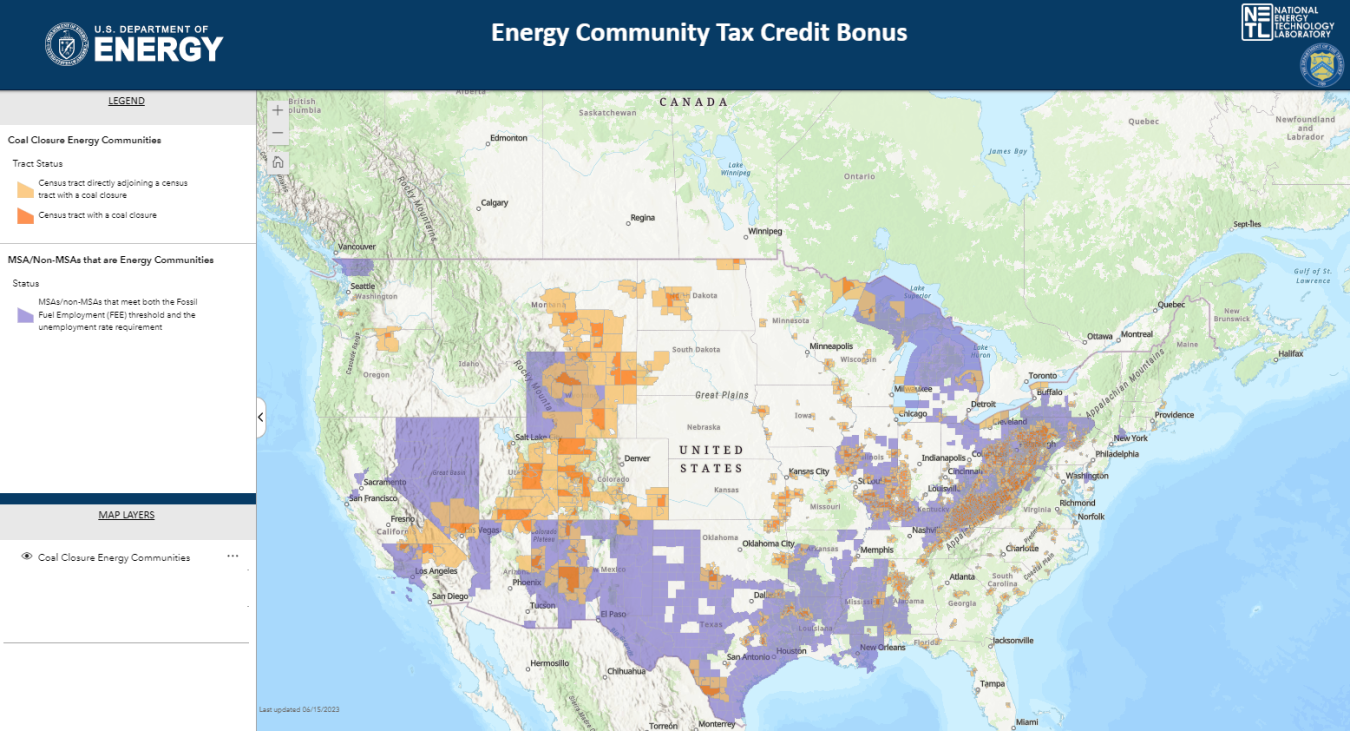

In April 2023, Treasury and IRS released guidance for the Energy Community Tax Credit Bonus, which applies to projects, facilities, and technologies located in energy communities. The IRA established the energy community tax credit bonus, which supports investment in communities with brownfields, retired coal infrastructure, or have significant fossil-related employment and tax revenues. The energy community tax credit bonus is an adder on top of the applicable base tax credit.

Brownfields |

A brownfield site (as defined in subparagraphs (A), (B), and (D)(ii)(III) of section 101(39) of the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (42 U.S.C. 9601(39))), OR |

Fossil employment and tax revenues |

A metropolitan statistical area or non-metropolitan statistical area which—(I) has (or, at any time during the period beginning after December 31, 2009, had) 0.17 percent or greater direct employment or 25 percent or greater local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Secretary), and(II) has an unemployment rate at or above the national average rate for the previous year (as determined by the Secretary), OR |

Coal closures and retirements |

A census tract—(I) in which—(aa) after December 31, 1999, a coal mine has closed, or(bb) after December 31, 2009, a coal-fired electric generating unit has been retired, or(II) which is directly adjoining to any census tract described in subclause (I). |

Example of EIR and Tax Credit Application: Coal Mine Site Redevelopment

As a hypothetical example, a developer wants to redevelop a coal mine that closed in 2002 into a utility-scale solar photovoltaic (PV) generating plant. The developer’s investment in solar PV qualifies for a 30% clean electricity investment tax credit – assuming the project pays prevailing wages and hires and trains registered apprentices. The energy community tax credit bonus is obtained because the coal mine was closed after 2000, bringing the total investment tax credit to 40% and improving the financials of the project enough to increase the capacity beyond the originally envisaged size. Should the project meet requirements to qualify for both the domestic content bonus and the low-income communities bonus credit, the overall investment tax credit could be 70%. An LPO loan guarantee from EIR helps to finance environmental remediation to stabilize the site and additionally supports the subsequent PV installation and grid interconnection.

Additional Resources

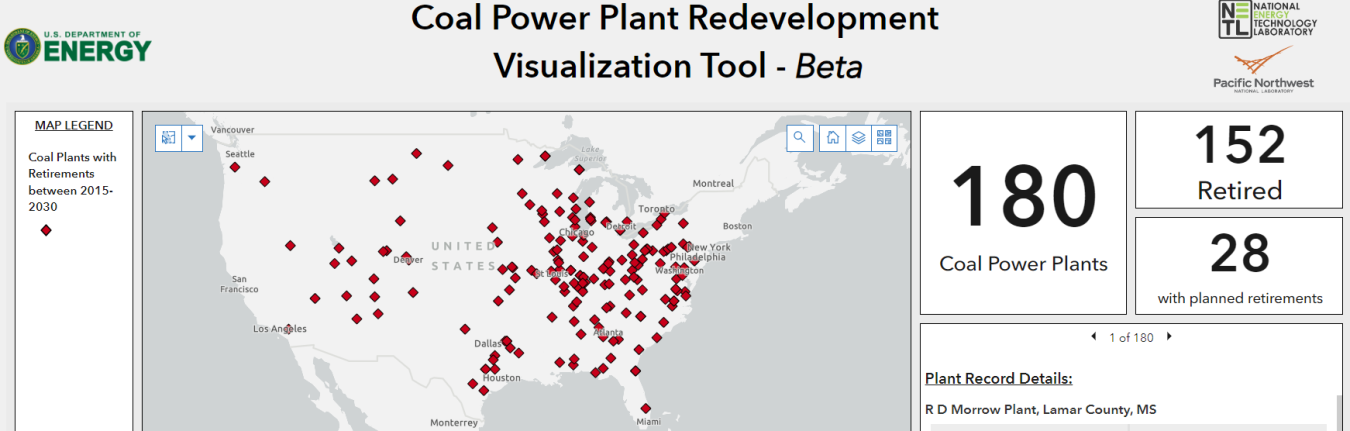

Investors and communities can explore what energy assets have been closed or set-to-retire that are relevant for potential redevelopment opportunities with the mapping tool hosted by the Interagency Working Group on Coal and Powerplant Communities & Economic Revitalization.

There is also a complementary searchable mapping tool that helps identify areas that may be eligible for the Energy Community Bonus Tax Credit from the Inflation Reduction Act.

Contributors: Davie Nguyen (DOE Office of Policy), Alyse Taylor-Anyikire (DOE Office of Policy), Liz Perera (DOE Loan Programs Office), and Dan Cross-Call (DOE Loan Programs Office)