Learn how the DOE Loan Programs Office (LPO) is supporting virtual power plant projects. (VPPs).

Office of Energy Dominance Financing

July 16, 2024

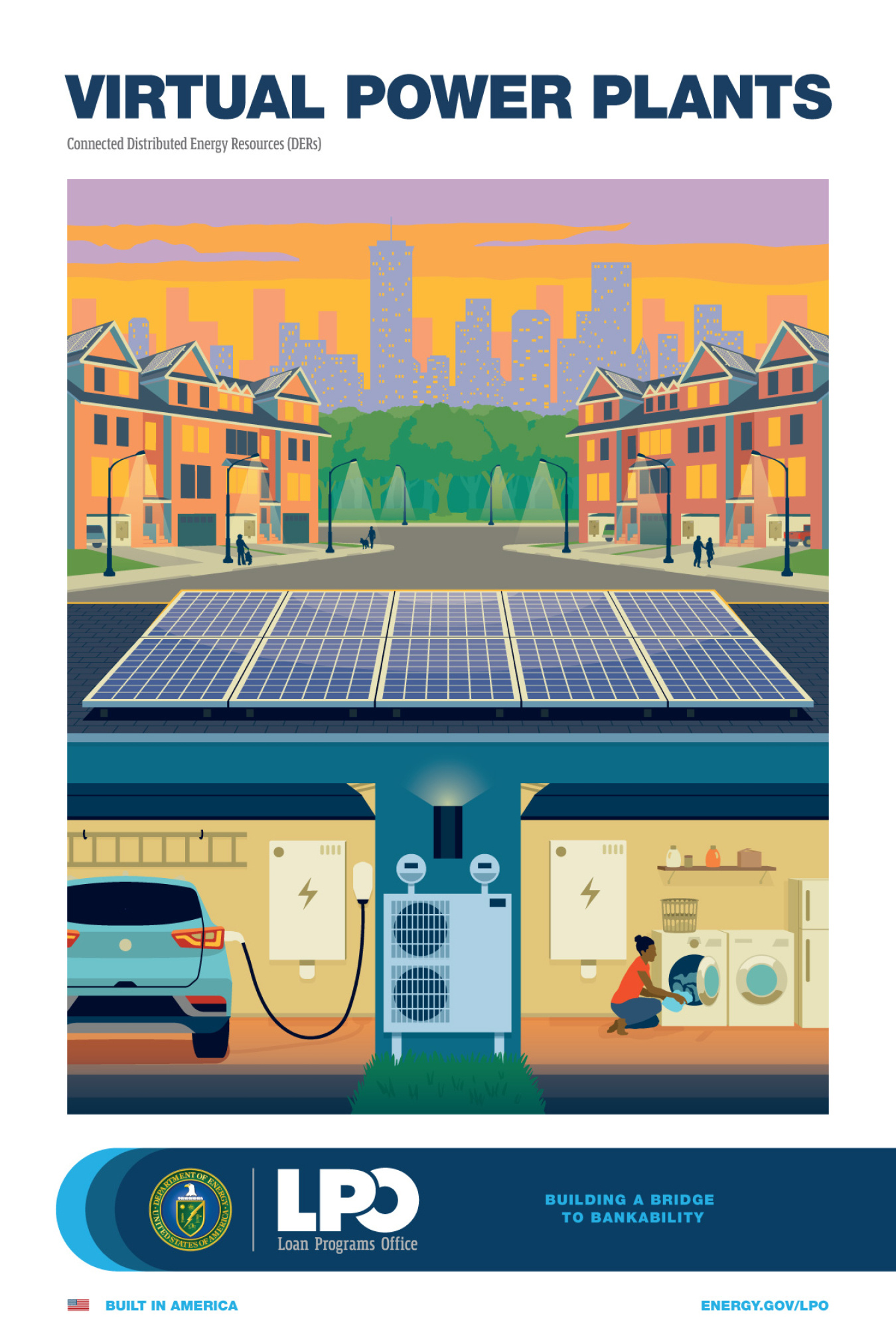

Download LPO's Virtual Power Plants poster.

This Sector Spotlight focuses on how DOE’s Loan Programs Office (LPO) can support virtual power plant (VPP) projects to add demand flexibility, increase affordable clean energy access, and prepare the grid for electrification at scale.

As the U.S. economy rapidly electrifies to meet climate targets, the grid will face an unprecedented increase in demand. VPPs can help smooth that transition. VPPs are aggregations of electrified, grid-connected devices such as air conditioners, grid interactive efficient buildings, solar-plus-storage systems, and plugged-in electric vehicles. When combined, these distributed energy resources (DERs) use, store, and/or generate significant amounts of energy. DERs can provide energy at a lower price than what the grid typically offers. They do so more cleanly while offering consumers greater resilience during adverse grid events.

By time-shifting and shaving electricity demand through DER management, VPPs can reduce a utility’s reliance on natural gas peaker plants and reduce the strain on transmission and distribution infrastructure. VPPs can decrease emissions and increase utilization of assets and capital efficiency, thereby reducing the energy cost burden on consumers and improving reliability. A leading study estimates that by 2050, VPPs could avoid 44-59 million metric tons of CO2 emissions per year. By avoiding generation build-out and new power infrastructure investments, VPPs can help avoid $17 billion of annual power sector expenditure by 2030.

VPPs rely on DER deployment at scale, and it is imperative to help make affordable, resilient, and clean energy accessible to all Americans. VPP software used by both consumers and VPP operators can reduce device electricity use during peak grid stress or, in some cases, prompt DERs to supply electricity to the grid, making VPP-enabled DERs a powerful collective tool—a “virtual power plant”—to support grid reliability in an increasingly electrified world.

LPO can support the adoption of VPP-enabled DERs through the Title 17 Clean Energy Financing program. As of the end of February 2023, VPP was the fifth most requested sector based on cumulative requested loan authority (over $300 million per project), behind only Advanced Vehicles & Components, Advanced Nuclear, Carbon Management, and Biofuels applications. For more current details, view LPO’s Monthly Application Activity Report, which explains the level of interest from applicants for LPO financing and what technology sectors have been most actively engaged with LPO.

To deepen understanding of how DOE can spur VPP deployment, LPO is supporting Secretary Granholm as she crosses the country to compile insights from those driving trailblazing aggregated energy projects. LPO is joining the Secretary at her first VPP Listening Roundtable in Austin, TX, to discuss with the Energy Reliability Council of Texas’ ADER Taskforce the reliability benefits of its statewide 80 MW VPP pilot. Future roundtables will highlight how lessons from other exemplary VPP projects can be applied in diverse energy markets across the United States.

For more insights into the market dynamics of VPPs and an overview of how LPO is actively working to support scaleup of the VPP sector, see:

- Distributed energy resources aggregated through VPPs through a combination of software and hardware can increase demand flexibility.

- VPPs can promote affordable clean energy to combat rising energy costs and provide an alternative to new infrastructure buildout.

- Solar plus storage can be combined in VPPs to maximize benefits of DER deployment to the grid.

- Two years after the announcement of FERC Order No. 2222, VPPs are just beginning to compete at scale, and utilities continue to have an important role to play.

Virtual Power Plants – Hestia

In September 2023, LPO announced the closing of a $3 billion partial loan guarantee to Sunnova Energy Corporation’s Project Hestia to make distributed energy resources (DERs), including rooftop solar, battery storage, and virtual power plant (VPP)-ready software, available to more American homeowners. Project Hestia is expected to prioritize a focus on households in disadvantaged communities across the United States, including Puerto Rico, as well as homeowners with lower credit ratings.

If finalized, the partial loan guarantee would enable Sunnova, a leading energy-as-a-service provider, to provide loans for clean energy systems for approximately 75,000 to 115,000 homeowners throughout the United States, including its territories. Over the next 25 years, the approximately 568 MW project is expected to avoid an estimated 7.1 million tonnes of carbon dioxide––equivalent to the emissions of 1.5 million gas-powered vehicles per year. The project is estimated to create over 3,400 jobs.

Virtual Power Plants – IceBrick

In December 2024, LPO announced a conditional commitment to a subsidiary of Nostromo Energy for Project IceBrick, a virtual power plant (VPP) consisting of cold thermal energy storage (TES) installations at commercial buildings across California. At full scale, the project could provide the equivalent of approximately 170 MW (450 MWh) of behind-the-meter storage capacity for hotels, offices, data centers, and other commercial buildings.

American-made IceBrick systems use affordable renewable energy to freeze water and later uses the ice to support cooling of the building during hours of peak demand, when the grid faces highest demand and electricity production is dirtiest and most expensive. Nostromo’s VPP software can control operation and performance of IceBrick systems either as standalone systems or in concert with one other as a VPP. By shifting commercial cooling loads away from times of peak usage, when electricity is at its most carbon-intensive, Nostromo’s IceBrick systems would allow California’s bulk power system to avoid up to 500 thousand tonnes of CO2 emissions over the project’s lifetime. As a VPP, Project IceBrick not only provides resilient power capacity, but also supports a higher rate of grid asset utilization, further tempering rate increases for Californians.

Virtual Power Plants: Project Polo

In November 2024, LPO announced a conditional commitment for a loan guarantee of up to $289.7 million to Sunwealth Holdco 18 LLC’s (Sunwealth) Project Polo. The loan guarantee, if finalized, will finance the deployment of up to 1,000 solar photovoltaic (PV) systems and battery energy storage systems (BESS) located primarily at commercial and industrial facilities and integrated across up to 27 states.

The project is expected to create approximately 3,700 jobs, including over approximately 1,900 solar and storage installation jobs and over 1,700 operations and maintenance jobs. Sunwealth is also committed to building its relationships with the International Brotherhood of Electrical Workers (IBEW) and the National Electrical Contractors Association (both national and locals) and local solar nonprofits and trade groups to integrate them into their developer workforce.

Systems would be deployed across commercial buildings, multi-family properties, community solar, and other sites across up to 27 states, with an estimated aggregate capacity of 168 MW of PV and 16.8 MW (33.6 MWh) of BESS. Sunwealth estimates the project will lead to the avoidance of up to 4.07 million metric tons of carbon over the project’s lifetime—helping slash harmful emissions that jeopardize public health and pollute local ecosystems.

VPP News Roundup

- Jigar Shah wants to fund your virtual power plant (Nexus Labs Podcast)

- EV virtual power plants could provide support in times of peak demand (Automotive News)

- Jigar Shah's big idea for getting rooftop solar and smart appliances to low-income Americans (Canary Media)

- What is a virtual power plant? (Reuters)

- Home of the future: Climate-friendly, electrified and closer than ever (Canary Media)

- Real barriers to virtual power plants (PV Magazine)

- US closes $3 billion loan guarantee for first 'virtual' power plant project (Reuters)

- DOE closes $3B partial loan guarantee with Sunnova in agency’s largest single commitment to solar (Utility Dive)

This blog was originally published on March 10, 2023, and is periodically updated.