The flow of LNG to markets, or the LNG value chain, starts at the wellhead.

Office of Fossil Energy and Carbon Management

April 1, 2022

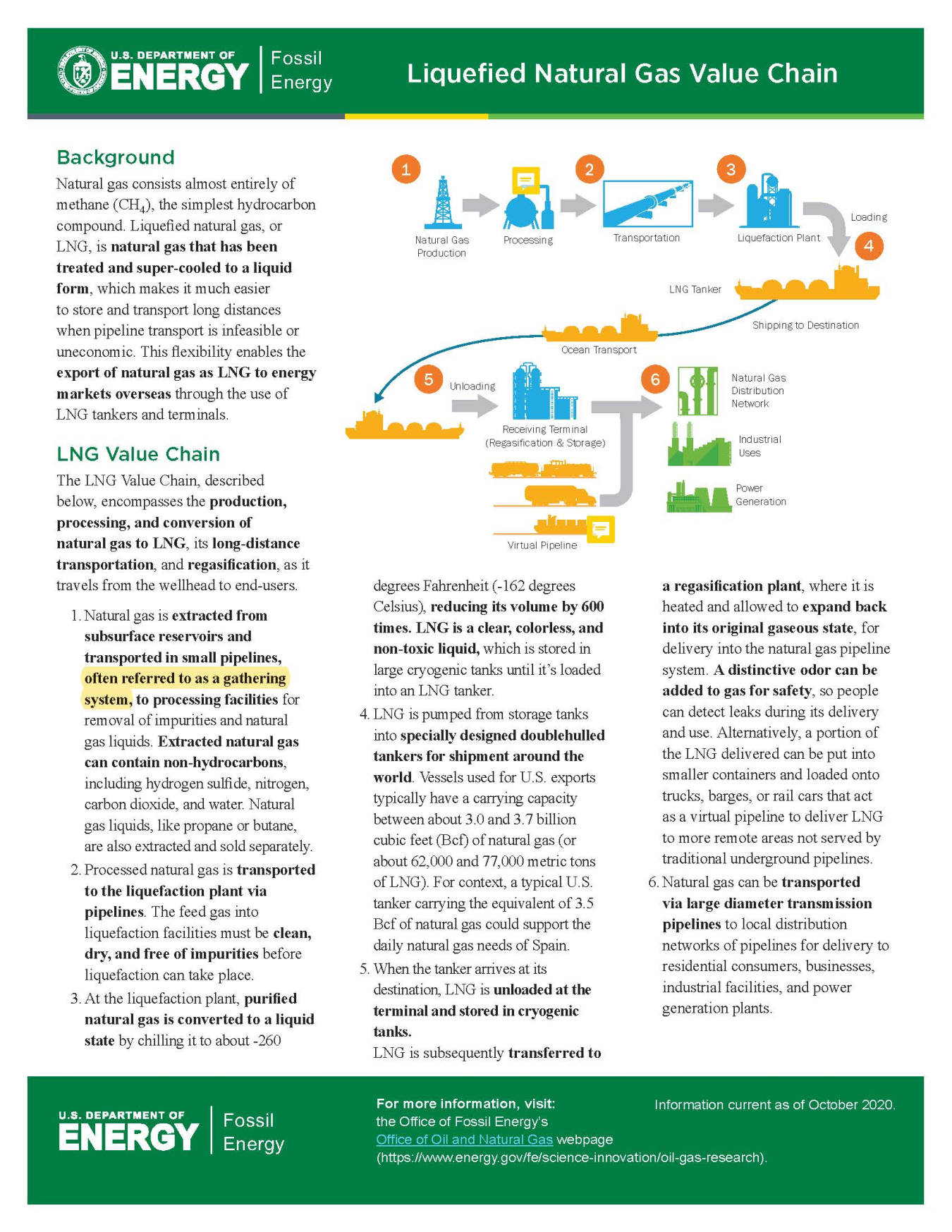

Figure 2. The Flow of LNG to Market. Courtesy of MJM Energy

LNG Value Chain

The flow of LNG to markets, or the LNG value chain, starts at the wellhead. Natural gas is extracted from subsurface fields, treated on site and/or transported by pipe to gas processing facilities for the removal natural gas liquids and other impurities, and then transported to a liquefaction facility for super-cooling into a liquid form. LNG is then loaded onto vessels and other carriers and transported to a destination, offloaded at receiving terminals, and stored in tanks. It then can be moved as LNG (via trucks, rail, or bunker vessels/barges), or it can undergo regasification and be transmitted in its gaseous form directly to large users or into a local pipeline distribution network to end-users.

Most LNG on the global market travels to and from large scale LNG facilities on large, double-hulled ships (LNG carriers) for transport by sea. These specialized vessels are configured both for safety and insulation of LNG. According to the International Gas Union (IGU), at the end of 2019, there were over 540 vessels in the global LNG fleet, including those LNG tankers actively sailing, in idle status, and acting as floating storage and regasification units (FSRUs).

LNG carriers have been transporting natural gas to global destinations since the late 1950s, starting with the Methane Pioneer – the world’s first oceangoing LNG tanker- carrying a LNG cargo from the Louisiana coast to the United Kingdom in 1959. LNG exports did not resume from the continental U.S. until 2016, but another LNG export facility began operations in Alaska in 1969 and operated for several decades. Since the 1970s, the global LNG trade market has grown, and currently there are 20 countries, including the U.S., that export LNG by vessels to over three dozen existing import markets around the world (IGU).

Special Focus: Utilizing Stranded Gas via Virtual Pipelines

Natural gas resources are considered “stranded” if they exist in locations that lack physical pipeline infrastructure, making it economically challenging to deliver natural gas to consumers. For example, oil producers can face a challenge in handling the “associated gas” that is produced along with crude oil. If there is no existing natural gas infrastructure, or new natural gas pipelines cannot be built, the associated gas may be flared or vented at the well site. Alternatively, capturing and converting this stranded gas into LNG or compressed natural gas (CNG) at the production site can allow the natural gas to be transported from producing regions to end-use markets, thus monetizing this otherwise unused resource.

A small number of oil and gas producers are beginning to utilize equipment to liquefy natural gas onsite with mobile, small liquefaction units delivered by trucks to the wellsite, where then the LNG can be stored in specially-made containers and transported by truck, rail, or port shipments to another location for use – thus creating “virtual pipelines.” Liquefying natural gas at the wellsite and transporting it via virtual pipelines can be an expensive, and sometimes technically challenging, venture. Thus, this growing practice is still not widely used in most countries. However, onsite gas liquefaction could allow operators to create a valuable and transportable product; enhance their environmental performance by reducing venting or flaring of the gas; and optimize and monetize recovery of gas supplies and deliver it to regional customers.

U.S. LNG Trade

In 2020, nearly 2 trillion cubic feet (Tcf) of natural gas in the form of LNG was exported from the U.S. Most LNG exports from the continental U.S. are transported by LNG ships to destinations around the world that carry cargos ranging in size between 2.7-3.6 Bcf. As LNG export capacity has increased in the U.S., so have LNG exports. LNG exports from the U.S. in 2020, averaged 6.5 billion cubic feet per day (Bcf/d) an increase of more than 30% from 2019. As of February 2021, U.S. LNG has been delivered to over three dozen countries on five continents. And while the U.S. is a net exporter of natural gas, there are still some imports of LNG into the U.S., primarily to New England and Puerto Rico. Both areas are constrained by limited natural gas pipelines and storage capacity.