RSS

Below are stories about manufacturing featured by the U.S. Department of Energy (DOE) Wind Energy Technologies Office.

Subscribe to the WETO E-Newsletter

Subscribe to the WETO e-newsletter to stay informed on the latest wind energy news, events, publications, and updates.

Report suggests investing in strategies and innovations to process the remaining 10%, supporting reuse and recycling.

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs offer competitively awarded grants to small businesses to support scientific excellence and technological innovation.

The U.S. Department of the Treasury and the IRS released final rules for the Advanced Manufacturing Production Credit (Section 45X of the Internal Revenue Code), to spur continued growth of U.S. renewable energy manufacturing.

Six teams were selected for creating cost-effective recycling technologies for U.S. wind energy systems.

While studying mechanical engineering at the University of Texas in Austin, Paquette became interested in structural components and composite materials. Although he originally planned to pursue work in the aerospace industry, he jumped at the opportunity to work at Sandia on wind turbine blades—the largest composite structures in the world.

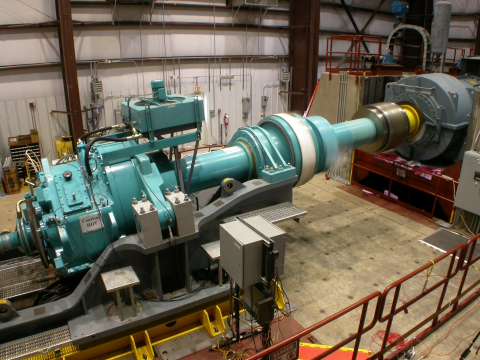

The Wind Energy Technologies Office (WETO) has funded the blade and drivetrain testing facilities since the 1990s, providing crucial knowledge and expertise to the ongoing expansion of commercial wind power—both domestically and globally.

The U.S. Department of the Treasury and Internal Revenue Service released additional guidance on the domestic content bonus provision enacted by the Inflation Reduction Act.

The Office of Manufacturing and Energy Supply Chains requests information on renewable energy supply chain data and analysis methods.

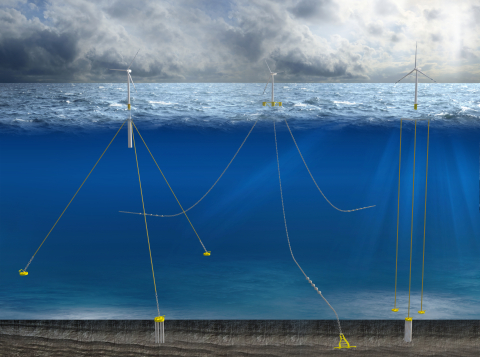

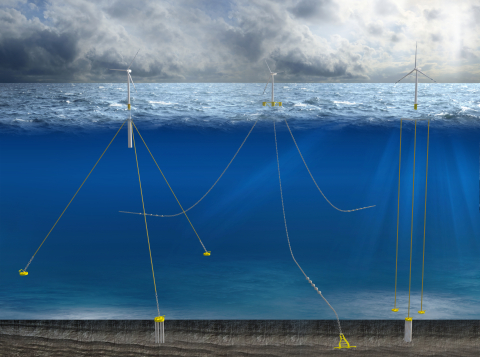

This proposed funding opportunity aims to improve mooring technologies and methods, which are used to secure floating platforms to the sea floor, for both the U.S. and Denmark.

Learn about recent guidance from the Internal Revenue Service on the advanced manufacturing production credit, which includes a new section that that offers benefits for wind energy technology manufacturers.