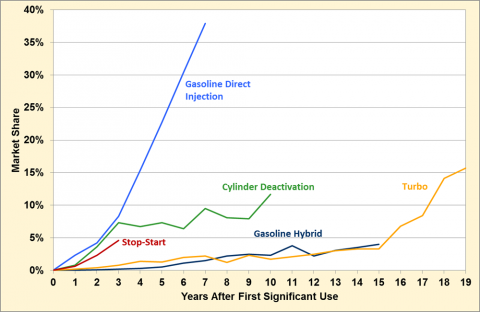

Gasoline direct injection (GDI) has seen rapid adoption since its first significant use. As automakers strive for improved fuel economy, many have turned to the combined benefits of GDI and turbo charging for increasing power output from downsized engines. This is evident in the rapid rise of turbo- charged engines in the last four years shown. Cylinder deactivation, which is seen mostly in 6 and 8- cylinder applications, has also seen greater use particularly in the last year, reaching nearly 12% market share. Stop-start technology in non-hybrid vehicles is relatively new in the U.S. market and has only been around for three years since its first significant use. However, in just three years, stop-start has reached 5% market share while gasoline hybrids have only grown to 4% market share in the past 15 years.

New Technology Penetration in Light Vehicles

Note: Stop-start technology data are for non-hybrid vehicles.

Supporting Information

| Years After First Significant Use | Gasoline Hybrid | GDI | CD | Turbo | Non-Hybrid Stop/Start |

|---|---|---|---|---|---|

| 0 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| 1 | 0.0% | 2.3% | 0.8% | 0.2% | 0.6% |

| 2 | 0.1% | 4.2% | 3.6% | 0.4% | 2.3% |

| 3 | 0.2% | 8.3% | 7.3% | 0.8% | 4.6% |

| 4 | 0.3% | 15.4% | 6.7% | 1.4% | |

| 5 | 0.5% | 22.7% | 7.3% | 1.3% | |

| 6 | 1.1% | 30.4% | 6.4% | 2.0% | |

| 7 | 1.5% | 37.9% | 9.5% | 2.2% | |

| 8 | 2.2% | 8.1% | 1.2% | ||

| 9 | 2.5% | 7.9% | 2.3% | ||

| 10 | 2.3% | 11.7% | 1.7% | ||

| 11 | 3.8% | 2.1% | |||

| 12 | 2.2% | 2.5% | |||

| 13 | 3.1% | 3.0% | |||

| 14 | 3.5% | 3.3% | |||

| 15 | 4.0% | 3.3% | |||

| 16 | 6.8% | ||||

| 17 | 8.4% | ||||

| 18 | 14.1% | ||||

| 19 | 15.7% | ||||

Source: Oak Ridge National Laboratory, 2014 Vehicle Technologies Market Report, ORNL/TM-2015/85, March 2015. | |||||