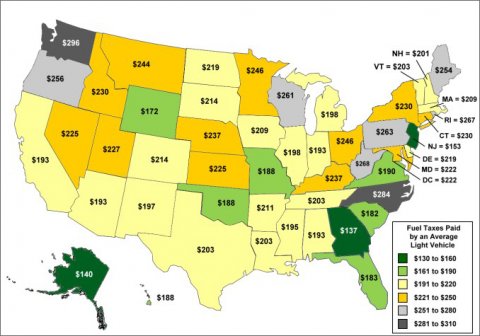

According to the Federal Highway Administration, the average fuel economy for all light vehicles on the road today is 21.4 miles per gallon (mpg). A person owning a gasoline vehicle with that fuel efficiency pays between $137 and $296 in fuel taxes each year, depending upon the state in which the fuel is purchased. The Federal tax on gasoline is 18.4 cents per gallon, and each state has a gasoline tax ranging from 7.5 cents in Georgia to 37.5 cents in the state of Washington. Since taxes are based on a per-gallon rate, someone with a more efficient vehicle will pay less in taxes over the course of a year and someone with a less efficient vehicle will pay more.

Average Annual Gasoline Tax Paid per Vehicle

Notes:

Includes Federal and State taxes on gasoline.

Assumptions: 11,318 annual miles of travel and 21.4 miles per gallon.

Supporting Information

| State | Average Annual Gasoline Tax Paid (Dollars) |

|---|---|

| Georgia | $137 |

| Alaska | $140 |

| New Jersey | $153 |

| Wyoming | $172 |

| South Carolina | $182 |

| Florida | $183 |

| Hawaii | $188 |

| Missouri | $188 |

| Oklahoma | $188 |

| Virginia | $190 |

| Alabama | $193 |

| Arizona | $193 |

| California | $193 |

| Indiana | $193 |

| Mississippi | $195 |

| New Mexico | $197 |

| Illinois | $198 |

| Michigan | $198 |

| New Hampshire | $201 |

| Louisiana | $203 |

| Tennessee | $203 |

| Texas | $203 |

| Vermont | $203 |

| Iowa | $209 |

| Massachusetts | $209 |

| Arkansas | $211 |

| Colorado | $214 |

| South Dakota | $214 |

| Delaware | $219 |

| North Dakota | $219 |

| D.C. | $222 |

| Maryland | $222 |

| Kansas | $225 |

| Nevada | $225 |

| Utah | $227 |

| Connecticut | $230 |

| Idaho | $230 |

| New York | $230 |

| Nebraska | $237 |

| Kentucky | $237 |

| Montana | $244 |

| Minnesota | $246 |

| Ohio | $246 |

| Maine | $254 |

| Oregon | $256 |

| Wisconsin | $261 |

| Pennsylvania | $263 |

| Rhode Island | $267 |

| West Virginia | $268 |

| North Carolina | $284 |

| Washington | $296 |

| Source: U.S. Department of Transportation, Federal Highway Administration, Highway Statistics 2011, Tables MF-121T, VM-1, and FE-21B. | |