RMI is developing a web-based platform to perform portfolio-level analysis, prioritize energy projects, and track and deliver results.

December 27, 2018Existing commercial buildings present a major opportunity for energy efficiency. Retro-commissioning and deep or staged retrofits of commercial buildings have shown that significant reductions in both energy use and peak demand are achievable; several projects are even targeting zero net energy operation. However, energy-efficiency commercial retrofit projects are not undertaken in significant numbers, usually for economic reasons. Deep retrofits disrupt a building’s economic activity by displacing the tenants who generate this revenue. Even if the retrofit itself is cost-effective, surrounding economic factors can weigh down the project.

Portfolio owners in the retail and office building sectors typically have the financial resources necessary to overcome these barriers, so the Rocky Mountain Institute (RMI) decided to focus the launch of its Portfolio Energy Optimization initiative on these sectors. Portfolios such as these contain many buildings with similar space plans, operating schedules, and construction and equipment types. The buildings are distinguished by climate zone and surrounding "economic context," including utility rate structures, local labor costs, available incentives, and more. This structure not only simplifies data collection, but it also supports deep technical-economic analyses that identify cohorts of buildings that would benefit from similar types of upgrades. This unlocks opportunities for economies of scale through bulk purchase and contracting.

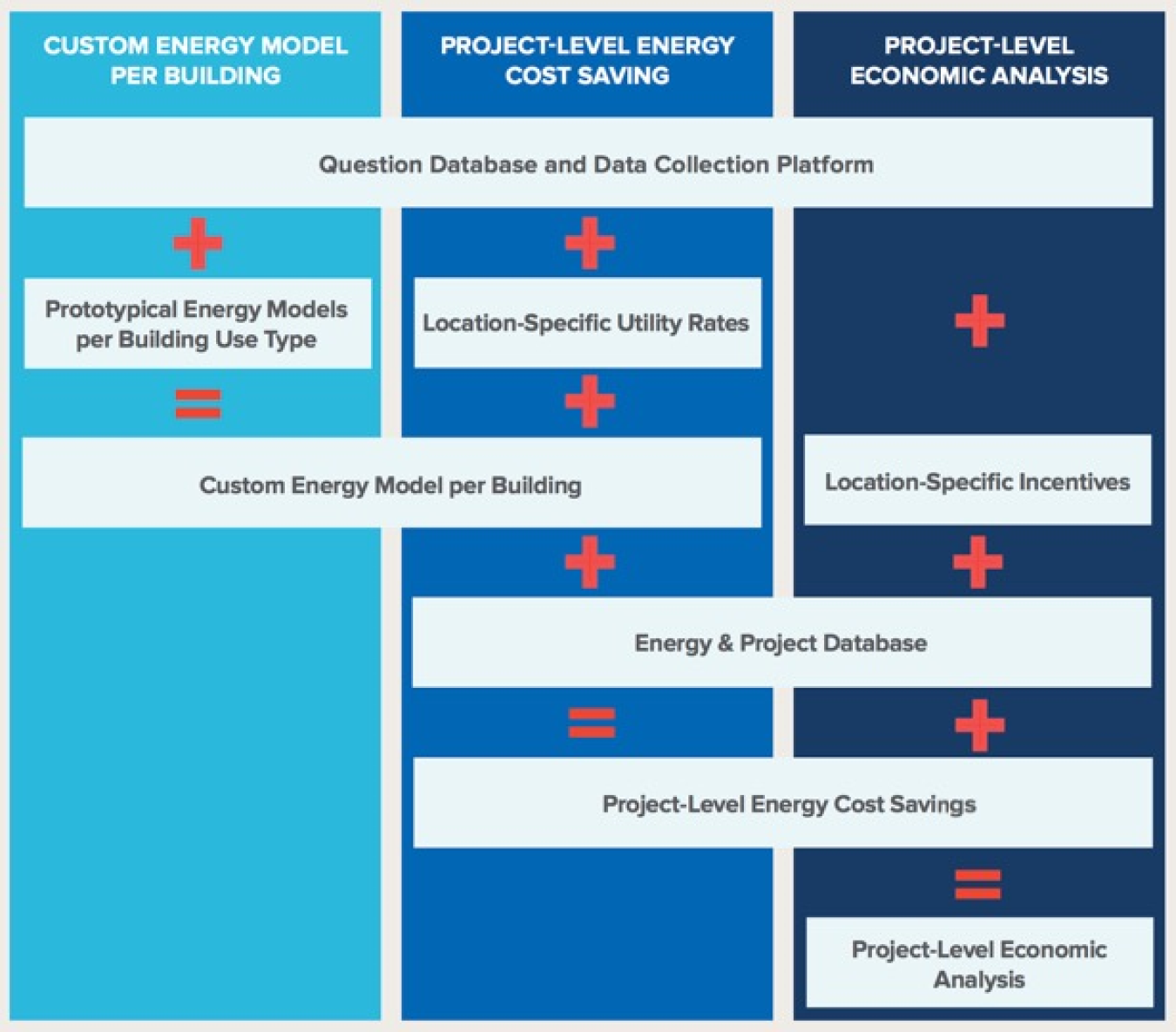

RMI is developing a web-based platform to perform portfolio-level analysis, prioritize energy projects, and track and deliver results in economic terms that resonate with these types of real estate owners. The platform is harnessing EnergyPlus as the underlying energy modeling engine. RMI selected EnergyPlus because of its transparency and ability to evaluate a holistic set of energy efficiency, renewable energy generation, energy storage, and demand-response solutions, which enables results to be compared consistently.

Energy modeling allows a range of project options, from capital energy-efficiency upgrades and operational changes to onsite generation and storage and demand response measures, to be evaluated on a level playing field. Credit: RMI.

According to Phil Keuhn, who manages the Portfolio Energy Optimization (PEO) initiative at RMI, EnergyPlus has been central to the initiative. "We are building the PEO tool to help building owners easily prioritize retrofit solutions based on their investment requirements. EnergyPlus has been incredibly powerful in enabling us to achieve this—especially as the energy market introduces more complex utility rate structures, demand response programs, and other variables that can dramatically influence project recommendations and therefore need to be incorporated into a sophisticated analysis tool."

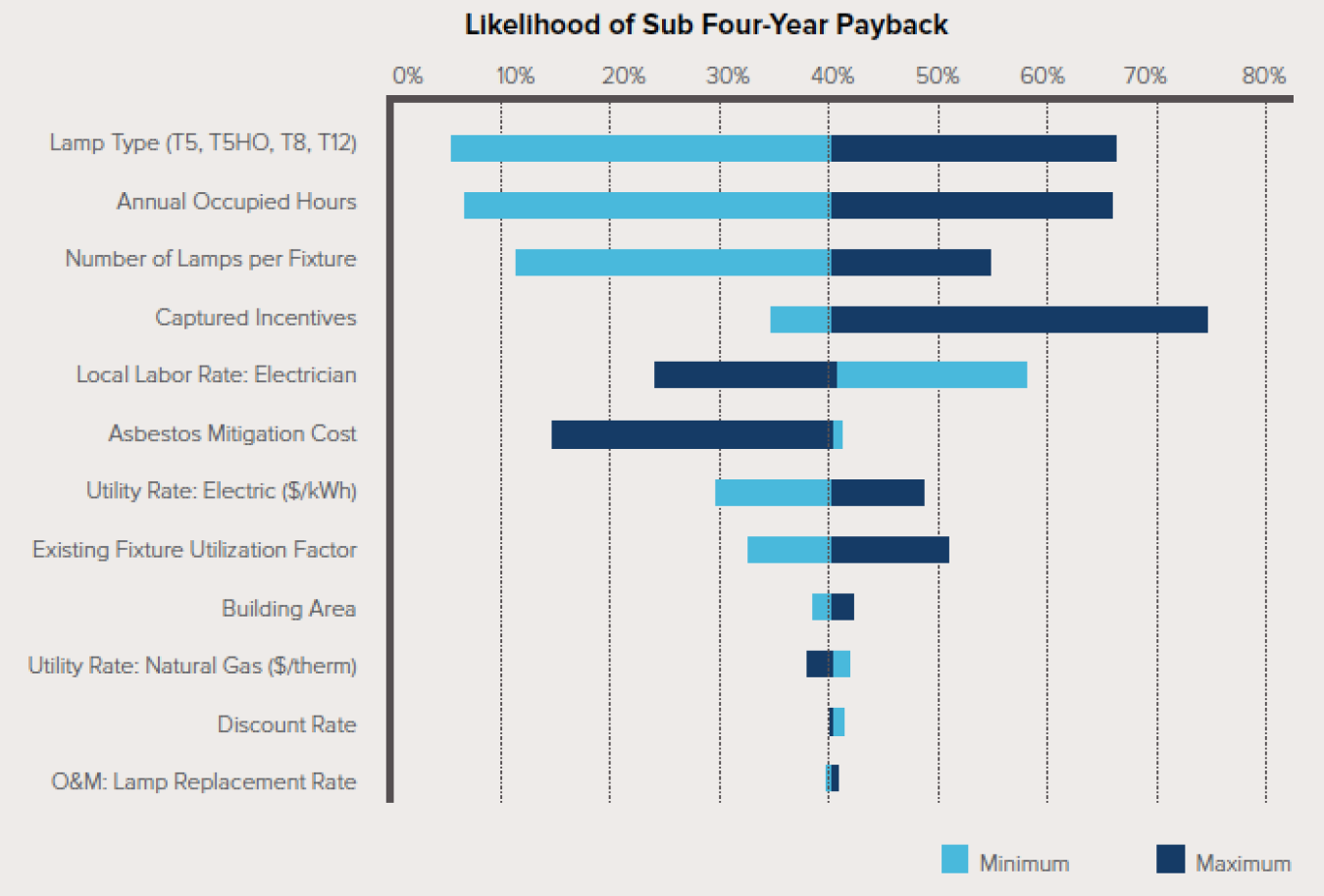

RMI is using building energy modeling not only to evaluate project alternatives, but also to streamline the data input process. Each of the portfolios' RMI targets is associated with one or more "prototypes." By performing a sensitivity analysis around each prototype, RMI was able to identify the key parameters that impact project economics and focus users on collecting those inputs, using defaults for parameters whose impact is minimal. This approach—which RMI calls "mass customization"—reduces the need for expensive, on-site inspections; increases engagement with the platform as new data typically yields meaningful differences in recommendations; and encourages action. RMI used Modelkit/Params, a Ruby-based template system developed by Big Ladder Software, to coordinate this large-scale analysis, generate model variants, and gather and synthesize simulation results.

RMI is complementing the portfolio analytics platform with technology demonstrations, field validation experiments, and individualized consulting. Early results have been promising. RMI recently published a report that describes the PEO approach, methodology, and results from its first experience with one of its earliest clients, the popular outdoor gear co-op Recreational Equipment Inc. (REI). REI operates 154 stores nationwide, along with three distribution centers and a data center. Even though REI is well-recognized in the retail industry for setting and pursuing ambitious sustainability targets, RMI was able to help REI identify even more savings opportunities, including a set of retrofit opportunities that would cut annual energy use by an additional 39%, save over 19,000 MWh a year, and pay for itself in under four years.

REI’s rationale for joining the initiative was about much more than improving its own energy profile, as Kirk Myers, former senior manager of Sustainability at REI, explained: “We want to show our customers how they can better protect the natural environment that they so enjoy and show our competitors a blueprint for reducing their own energy use. We want to show real estate owners what’s possible. If we can use RMI’s process to minimize our environmental footprint while enabling and guiding others to follow our lead, that’s how we’ll really win.”

Performing sensitivity analysis on a measure level helps identify key parameters, reducing data collection burden while explicitly accounting for uncertainty and risk in the project. Credit: RMI.

Dr. Amir Roth

Dr. Amir Roth is the technology manager for BTO’s Building Energy Modeling (BEM) subprogram and has served in that role since 2010. From 2001 to 2010 he was first an assistant and then an associate professor with tenure of Computer and Information Sciences at the University of Pennsylvania in Philadelphia. He graduated magna cum laude with a B.S. in physics from Yale University and holds a Ph.D. in computer science from the University of Wisconsin—Madison where he won a dissertation award in 2001. He is a member of the American Society of Heating, Refrigeration, and Air-Conditioning Engineers (ASHRAE), and the International Building Performance Simulation Association (IBPSA).

Email Amir Roth ►