As described in our recent blog post, “Getting to Know the Loan Programs Office,” LPO helps to fill a gap in access to adequate debt capital for the commercial deployment of decarbonization technologies by serving as a bridge to bankability for innovative and high-impact energy technologies. LPO provides access to needed loans and loan guarantees when private lenders cannot or will not until a given technology has reached full market acceptance.

With the passage of the Bipartisan Infrastructure Law (BIL) last year, and the Inflation Reduction Act (IRA) last month, LPO now has the tools and the loan authority to facilitate the deployment of innovative technologies that decarbonize the energy sector, build new energy infrastructure and reinvest in existing infrastructure, bolster the domestic advanced technology vehicle supply chain, and support clean energy development on Tribal lands.

With all the recent expansions of the program, in this three-part blog series I’d like to reintroduce LPO and its broadened mission and explain why we’re up to this challenge.

First, I’ll touch on three longstanding LPO loan programs—Innovative Clean Energy (Title 17 section 1703), the Advanced Technology Vehicles Manufacturing Loan Program (ATVM), and the Tribal Energy Loan Guarantee Program (TELGP)—and changes to these programs through BIL and IRA.

Later this week, I’ll detail the new Energy Infrastructure Reinvestment (EIR) Program (Title 17 section 1706), which was created by IRA to enable the Secretary to guarantee loans to revitalize energy infrastructure that has ceased operations, or to make the operation of energy infrastructure more efficient.

Next week, I’ll conclude with a preview of what’s to come with the Carbon Dioxide Transportation Infrastructure Finance and Innovation Program (CIFIA), a loan and grant program created by BIL to support common carrier carbon dioxide transportation infrastructure.

1. New Energy in Existing LPO Programs

The Bipartisan Infrastructure Law and Inflation Reduction Act reinvigorate LPO’s existing programs. It’s a smart move. The Loan Programs Office has a track record of helping deploy clean and innovative technologies while protecting taxpayer interests. Of the nearly $32 billion that has been disbursed to date, $13.61 billion in principal has been repaid, along with $4.21 billion in interest, with interest alone exceeding losses by more than $3 billion. Through FY 2021, LPO projects have created 37,000 permanent jobs, and projects have displaced the equivalent of nearly 65 million tonnes of CO2 emissions. Just one recent loan conditional commitment announced this summer for battery cell manufacturing facilities across three states is expected to create up to 6,000 good-paying construction jobs and 5,100 operations jobs at full capacity and would be among the largest battery cell operations in the United States. LPO investment can move the needle.

BIL and IRA build on LPO’s proven track record and augment its existing programs in meaningful new ways.

Tribal Energy Loan Guarantee Program (TELGP)

I want to start with TELGP because this important program is often overlooked as LPO’s newest program and because we have yet to close a loan under it. While authorized in 2005, it was not provided appropriations until 2017; just last year we received our first application. As originally authorized, TELGP borrowers seeking partial loan guarantees needed to partner with a commercial lender to access debt. These and other items have made it difficult for Tribes to access the program.

Here’s why we believe that’s about to change.

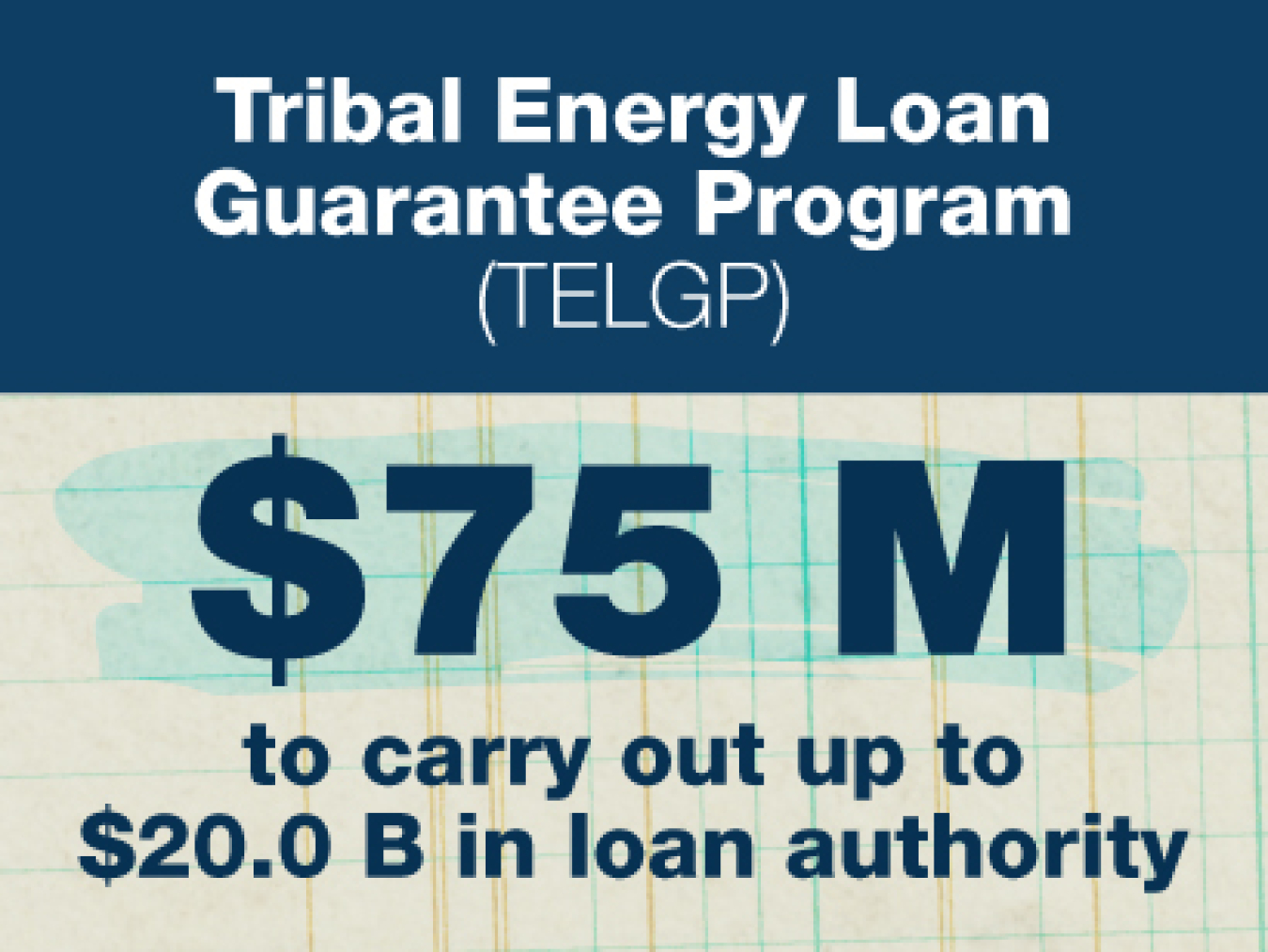

The IRA increases from $2 billion to $20 billion the total amount of loans the Secretary can issue under TELGP. This is a good thing, as we’ve heard from Tribes ready to submit applications for loans that total over the previous $2 billion in authority. IRA also provides an additional $75 million to carry out the program, which should address some of the concerns addressed by Tribes about having to pay fees to the program.

But IRA makes one other important change we’re excited about, first enacted by Congress in the Consolidated Appropriations Act, 2022: it makes permanent Tribal borrowers’ ability to apply for direct loans through TELGP from the U.S. Treasury’s Federal Financing Bank (FFB). While partial loan guarantees remain available, access to direct loans through FFB eliminates the need for a Tribal borrower to also secure a commercial debt partner. In addition to other LPO updates to this program, where we have incorporated Tribes’ feedback on fees and eligibility issues, this direct lending authority is expected to greatly simplify Tribes’ utilization of the program for energy development investments. TELGP is a major part of LPO’s commitment to supporting President Biden’s Justice40 Initiative, which aims to ensure federal agencies deliver 40% of the overall benefits of climate, clean energy, affordable and sustainable housing, clean water, and other investments to underserved and overburdened communities.

Innovative Clean Energy (Title 17 section 1703)

LPO’s Innovative Clean Energy Loan Guarantee Program (Title 17 section 1703) has a broad remit. It’s helped deploy innovative clean hydrogen production and storage, renewables, advanced nuclear, and industrial decarbonization projects, among others.

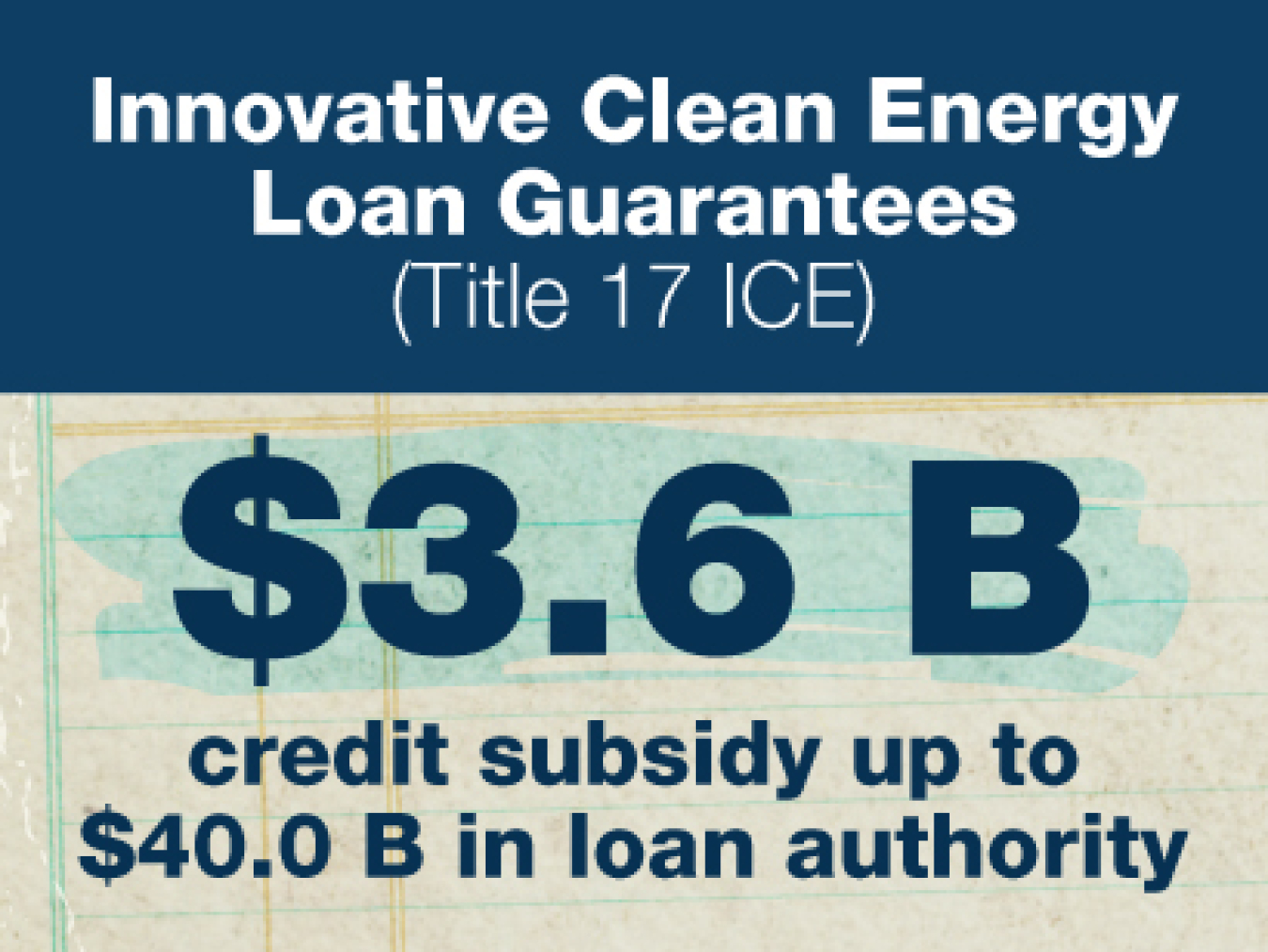

IRA provides $40 billion in new loan authority for these Innovative Clean Energy loan guarantees. Taken together with existing Title 17 loan authority, LPO has approximately $62 billion in loan guarantee authority available to new projects.

This sounds like a lot—and it is. But let me put it in context.

IRA appropriations unlock Innovative Clean Energy authorities that were expanded, but not funded, under the Bipartisan Infrastructure Law (BIL). For example, BIL expanded the ability of LPO to support critical minerals processing, manufacturing, and recycling. In addition, BIL allowed for projects that are receiving financial support by a state energy financing institution—state energy authorities, green banks, and others—to be exempt from Title 17 section 1703 innovation requirements, opening the door for projects that incorporate already commercial technologies, such as virtual power plants (VPPs) and aggregation of smaller projects, to be eligible for LPO loan guarantees. We expect a lot of interest from applicants in these areas.

Incorporating these changes will require LPO to undergo an upcoming public rulemaking, which was the subject of a recent Request for Information (RFI). (In the meantime, interested applicants should contact LPO to request a pre-application consultation by emailing lpo@hq.doe.gov.) But if you combine these changes with the volume of applications we have in Innovative Clean Energy to date it’s clear that, thanks to BIL and IRA amendments, LPO will have an outsized role to play in decarbonizing the energy sector and the clean energy supply chain.

Advanced Technology Vehicles Manufacturing Loan Program (ATVM)

Finally, recent legislative activity has greatly expanded the reach of the Advanced Technology Vehicles Manufacturing Loan Program.

The Bipartisan Infrastructure Law expanded ATVM’s ability to issue direct loans beyond light-duty vehicles to support manufacturing facilities for medium- and heavy-duty vehicles, locomotives, maritime vessels (including offshore wind support vessels), aviation, and hyperloop – and related qualifying vehicle components. Now with the IRA, these additional categories of advanced vehicles must emit, under any possible operational mode or condition, low or zero exhaust emissions of greenhouse gases. While these are very exciting amendments, BIL did not fund these efforts.

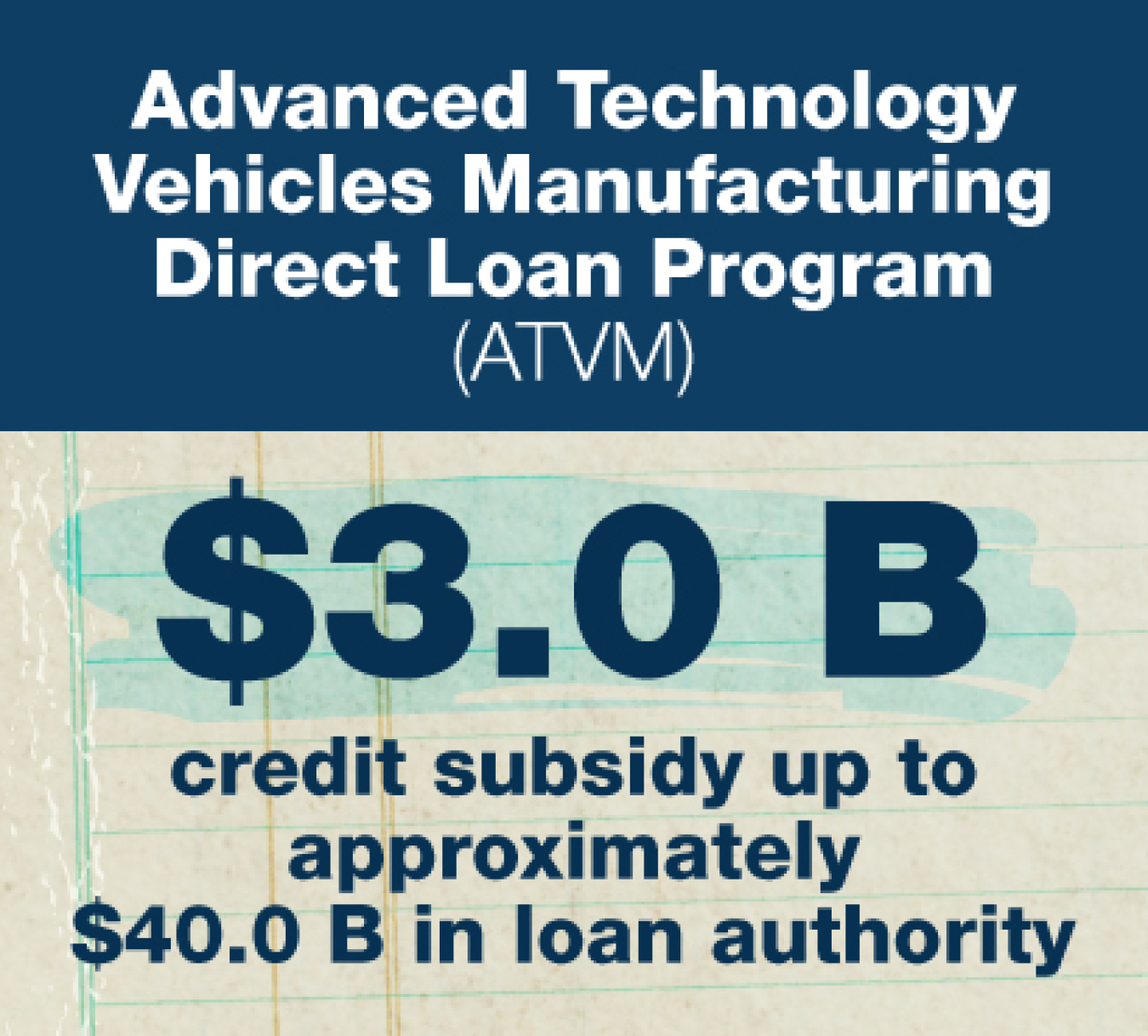

IRA changes that in a big way. First, the legislation removed the existing $25 billion statutory cap on the total amount of ATVM loans, established under the Energy Independence and Security Act of 2007. This means the program is no longer bound to an arbitrary limit for the total amount of loans it can issue if it has appropriated credit subsidy available to support the cost of those loans. Second, IRA appropriates $3 billion in credit subsidy to support new ATVM loans. This includes the ability to support BIL-expanded transportation modes for the first time ever. We estimate that this amount allows LPO to provide an additional $40 billion in new ATVM loans to any eligible advanced technology vehicle manufacturing project.

***

All of these changes to existing LPO programs will take time to implement. But we’re encouraged by applicants’ enthusiasm and interest in our loan offerings to date, and we expect the volume of applicants in existing solicitations to increase in the near term. This year, we anticipate releasing a Notice of Proposed Rulemaking (NOPR) on the Title 17 solicitation, informed by the previously mentioned RFI.

Next up: on Thursday, I’ll outline a new program created by the IRA, the Energy Infrastructure Reinvestment (EIR) Program.