Step one: decide to go solar. Step two: figure out how to pay for it.

Most households don’t have the cash to pay the upfront costs of a new solar installation, so people commonly finance a residential rooftop solar energy system with a loan or power purchase agreement. However, these methods omit nearly half of Americans who don’t have access to a suitable rooftop, which is why the SunShot Initiative launched the Solar in Your Community Challenge. This challenge spurs the development of new and innovative financial and business models that serve non-rooftop solar users (e.g., renters) through community solar installations.

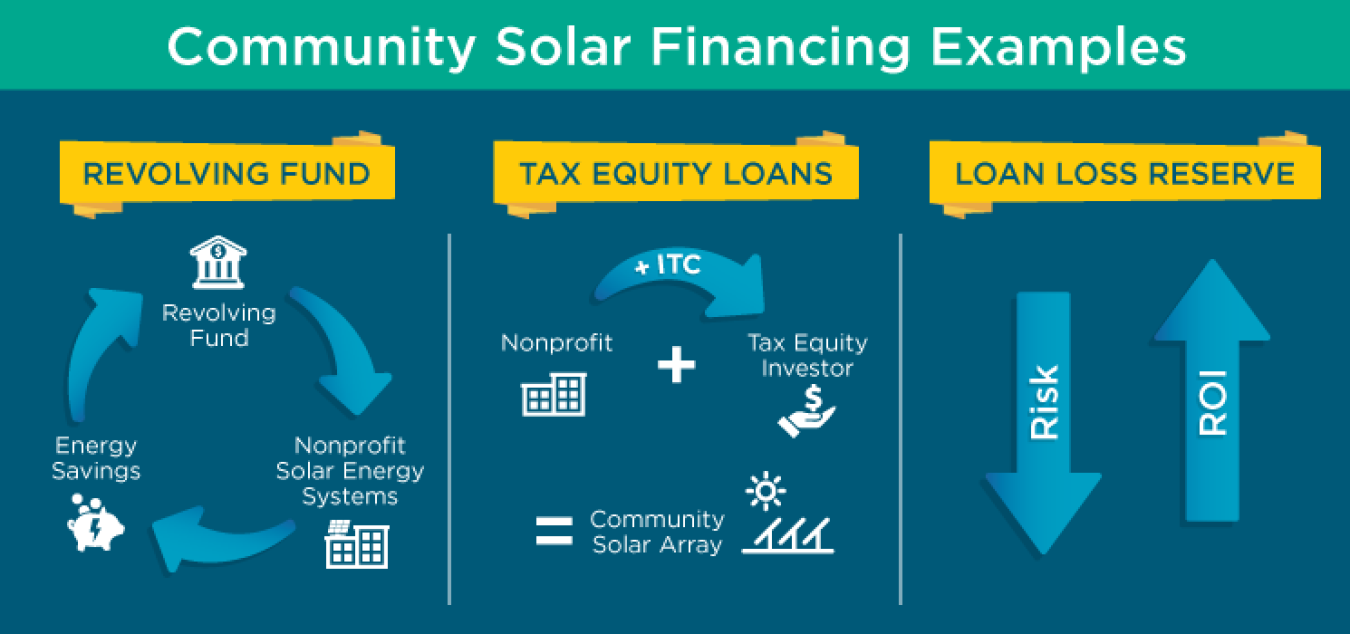

Below, we list three different ways SunShot’s challenge teams are bringing solar into their communities.

Pay It Forward

Among the newly selected projects, one team is using a financing model that uses electricity cost savings from one project to help pay for the next—setting in motion a pay-it-forward model for solar energy. Known as a revolving fund, this method creates a sustainable funding cycle while growing the fund through donations. RE-volv, a nonprofit based in San Francisco, uses this model to install rooftop solar for other nonprofit organizations. RE-volv leases the panels to an organization, then sells them back the generated power, saving organizations money on their monthly electric bills that can then be reinvested in their missions. By the end of the challenge’s performance period, RE-volv hopes to help more than 10 nonprofits go solar.

Tax-Equity Loans

A challenge team led by Sustainable Northwest is using tax-equity loans to bring community solar to rural Oregon. These loans let an investor make an equity investment in a solar energy system from Sustainable Northwest and allow the investor to receive the project’s Investment Tax Credit (ITC). The ITC represents approximately 30% of all costs associated with the construction and installation of a solar energy system. By selling back the energy to Sustainable Northwest and collecting the entire ITC reimbursement, the project becomes an attractive investment and allows the challenge team to access the capital it needs up front. The team will use technical assistance to identify tax-equity partners with the hopes of using this model to build at least 3 of its 20 community solar projects by 2020.

Reduce the Risk

Finally, the City of Baltimore is using a financing model that reduces the risks of financing community solar installations. Loan loss reserve (LLR) funds reduce investors’ risk by providing payments in the case of a loan default. This allows Baltimore to raise a small pool of funds to ensure a fair return on investment. Additionally, for every dollar that investors place in the LLR, Baltimore will be able to access an additional $10 in project investment. This approach helps Baltimore meet its goal of providing solar energy to 1,000 low-income households. Learn more about how LLR funds work.

These three projects demonstrate how innovative finance mechanisms are vital in bringing solar to communities. Financing is critical to solar deployment, and innovations in this space have the potential to cut the cost of solar energy to customers and businesses by 30%–60%, making solar an option for more Americans. As we approach the final deadline for the Solar in Your Community Challenge, the Department of Energy hopes to see more extraordinary plans for financing projects that increase access to solar.