The Better Buildings Neighborhood Program is partnering with organizations nationwide to design and implement innovative financing programs that offer consumers low-cost, long-term loans―with the goal of making energy efficiency upgrades more affordable to consumers than ever before.

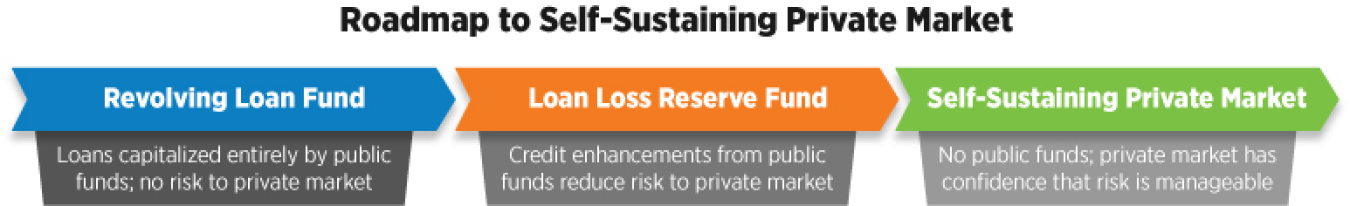

The U.S. Department of Energy's (DOE's) primary objective is to help communities develop self-sustainable private financing markets for energy upgrades. Financing programs may start out with government assistance but can evolve over time to become an important financial resource for the community.

To create financing options and products for energy efficiency upgrades, Better Buildings partners follow 10 key steps.

Step #1: Assess the Market

Step #2: Define Finance Program Objectives

Step #3: Identify and Engage Financial Partners

Step #4: Design the Financing Program

Step #4a: Choose Your Program Structure—Credit Enhancements

Step #4b: Choose Your Program Structure—Revolving Loan Funds

Step #5: Draft and Evaluate RFPs

Step #6: Implement Finance Program Initiatives

Step #7: Determine Loan Marketing Channels

Step #8: Evaluate Program Performance

Step #9: Revise Programs and Strategies

Step #10: Capture Lessons Learned

Each of these sections provides tools, resources, and real-life examples that can help you, as a program administrator, design and implement your program.

KEY RESOURCES

Clean Energy Finance Guide for Residential and Commercial Building provides a collection of knowledge on the development of energy efficiency financing programs.

DOE Solution Center: Financing for Energy Efficiency and Renewable Energy provides a variety of information about setting up financing programs.

EPA's "Clean Energy Financing Programs: A Decision Resource for States and Communities" and Financing Program Decision Tool were designed for state and local governments interested in developing a financing program to support energy efficiency and clean energy improvements.